Accounting

General: Choose Option | General: Default Accounts and Tax Codes | Accounts Receivable | Creditors | Revenue | Expenditures | Cost Centres | Tax RatesGeneral: Choose Option

What are the benefits of the accounting section?

MOCO focuses on project business and offers simple accounting preparation that doesn't burden the daily work routine, reduces the effort of accounting, and ensures a parallel overview.

▶️ Tobias from MOCO introduces the activatable accounting in this video

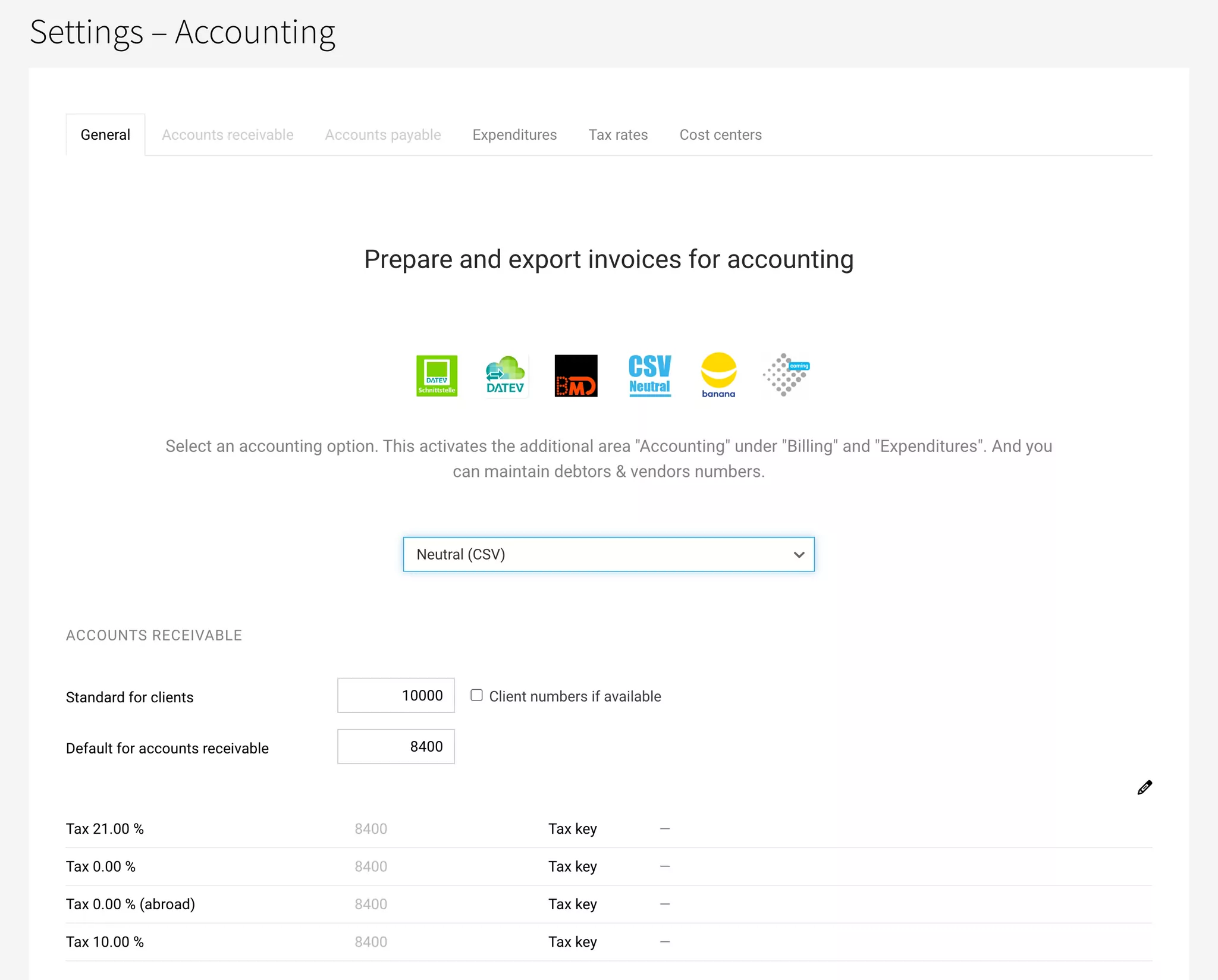

Settings > Accounting > General

Settings > Accounting > General

After selecting an accounting option, an additional sub-item "Accounting" for accounting export (data and documents) appears in the "Invoicing" and "Expenditures" sections.

- Neutral

- DATEV Format

- DATEV Unternehmen online (Direct Transfer)

- BMD for Austrian Accounts

- Banana for Swiss Accounts

- Abacus for Swiss Accounts

Neutral (CSV)

Neutral accounting export in CSV format, provided for import along with the collectively downloaded documents for accounting.

Custom Extension

The CSV is automatically extended to include custom fields (invoice level – type single choice and single-line text).

Custom Extension

The CSV is automatically extended to include custom fields (invoice level – type single choice and single-line text).

DATEV Format (CSV)

CSV export in DATEV format (called "booking stack"), provided to the tax advisor along with the collectively downloaded documents. The tax advisor imports the booking stack into DATEV (e.g., Kanzlei Rechnungswesen and DATEV Mittelstand Faktura mit Rechnungswesen).

DATEV Unternehmen online (Direct Transfer)

Invoice data including documents are transferred directly to DATEV Unternehmen online with a click. After provision, you or your tax advisor can retrieve the data as booking proposals – depending on whether financial accounting with DATEV is done by you or your tax advisor.

How to set it up:

1. Your tax advisor has ordered and set up the DATEV Invoice Data Service 1.0 in DATEV for you. If you handle financial accounting yourself, you can independently activate the Invoice Data Service 1.0. More information can be found » here. Since setting up in DATEV is not straightforward, DATEV offers support for ordering the data service and setting it up in DATEV.

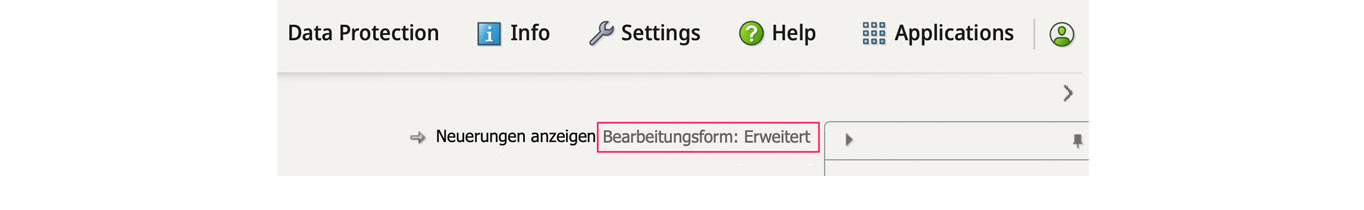

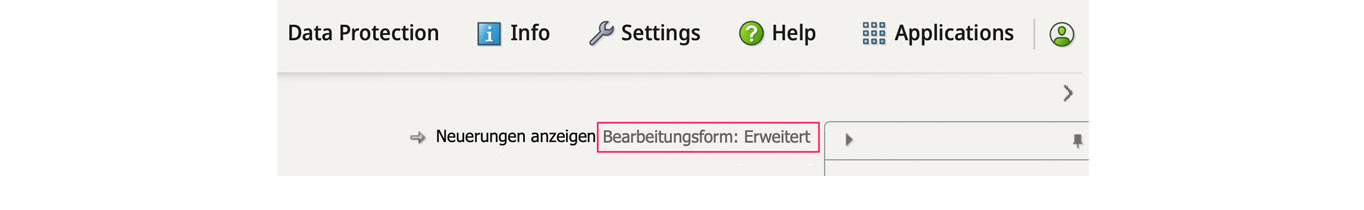

2. In DATEV Unternehmen online, the advanced editing form is activated (see image).

(English image not yet available)

(English image not yet available)

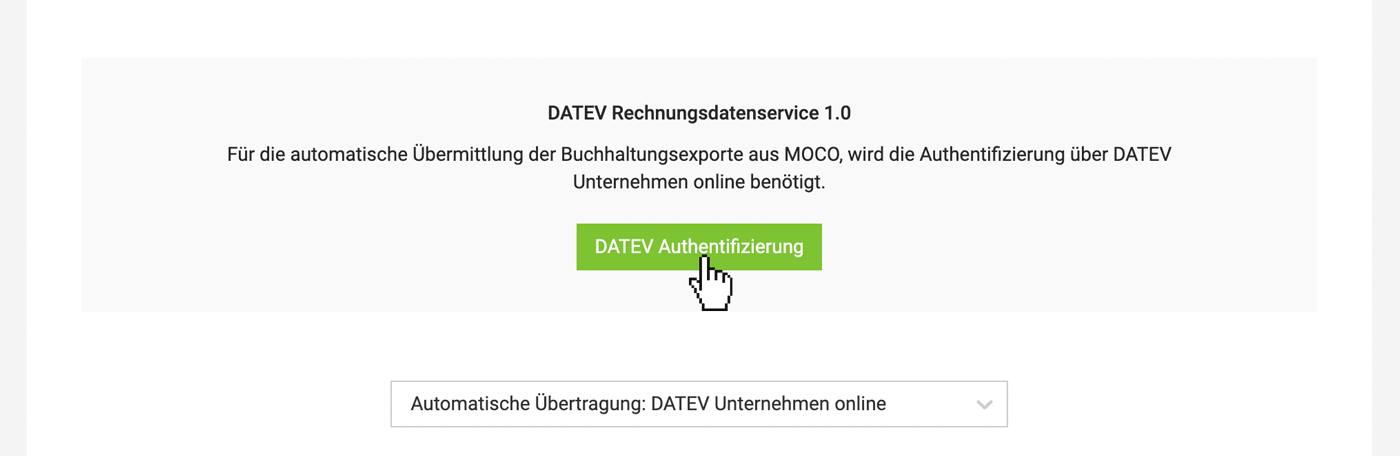

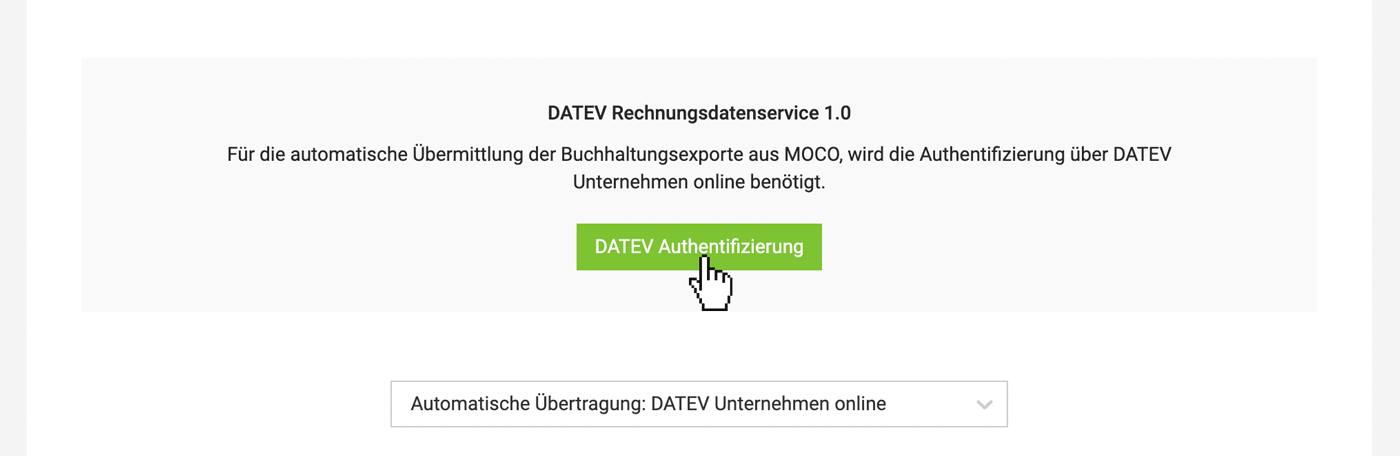

3. After selecting and saving "Direct Transfer to DATEV Unternehmen Online," DATEV authentication is required. You need DATEV SmartLogin for this. Access to DATEV SmartLogin is granted after successfully ordering the interface. If you already have a DATEV SmartLogin, it will be equipped with the necessary rights during the activation process.

(English image not yet available)

(English image not yet available)

4. Once the connection is set up, create an export. With the export, DATEV assigns a "long-term token," so you don't have to log in every time.

5. For issues and error messages visit the help page.

How to set it up:

1. Your tax advisor has ordered and set up the DATEV Invoice Data Service 1.0 in DATEV for you. If you handle financial accounting yourself, you can independently activate the Invoice Data Service 1.0. More information can be found » here. Since setting up in DATEV is not straightforward, DATEV offers support for ordering the data service and setting it up in DATEV.

2. In DATEV Unternehmen online, the advanced editing form is activated (see image).

(English image not yet available)

(English image not yet available)3. After selecting and saving "Direct Transfer to DATEV Unternehmen Online," DATEV authentication is required. You need DATEV SmartLogin for this. Access to DATEV SmartLogin is granted after successfully ordering the interface. If you already have a DATEV SmartLogin, it will be equipped with the necessary rights during the activation process.

(English image not yet available)

(English image not yet available)4. Once the connection is set up, create an export. With the export, DATEV assigns a "long-term token," so you don't have to log in every time.

5. For issues and error messages visit the help page.

BMD (CSV)

For companies in Austria

Export tailored to the BMD accounting software (Austria). Incoming and outgoing invoices (invoice data and documents) can be exported from MOCO and then imported into BMD by accounting/tax advisors. The structured invoice data (CSV) is prepared specifically for BMD.

More info

Tip for importing into BMD

If all documents are unzipped in the same folder as the CSV file, BMD can directly assign the documents.

Export tailored to the BMD accounting software (Austria). Incoming and outgoing invoices (invoice data and documents) can be exported from MOCO and then imported into BMD by accounting/tax advisors. The structured invoice data (CSV) is prepared specifically for BMD.

More info

Tip for importing into BMD

If all documents are unzipped in the same folder as the CSV file, BMD can directly assign the documents.

Abacus

For companies in Switzerland

MOCO exports invoices optimized for Abacus as a Zip file (xml + PDF documents). You can upload the Zip file directly into Abacus.

More info

MOCO exports invoices optimized for Abacus as a Zip file (xml + PDF documents). You can upload the Zip file directly into Abacus.

More info

Banana (CSV)

For sole traders and small businesses in Switzerland

With the integration, MOCO simplifies the workflow. Through the MOCO file interface, invoice data can be exported in the appropriate format for Banana – and then transferred to Banana via copy-paste. Banana Accounting Option: Setup and Workflow

With the integration, MOCO simplifies the workflow. Through the MOCO file interface, invoice data can be exported in the appropriate format for Banana – and then transferred to Banana via copy-paste. Banana Accounting Option: Setup and Workflow

Next Steps

After choosing the accounting option, coordinate with your accounting department to set up accounts, etc. MOCO is then ready for accounting export.

General: Default Accounts and Tax Codes

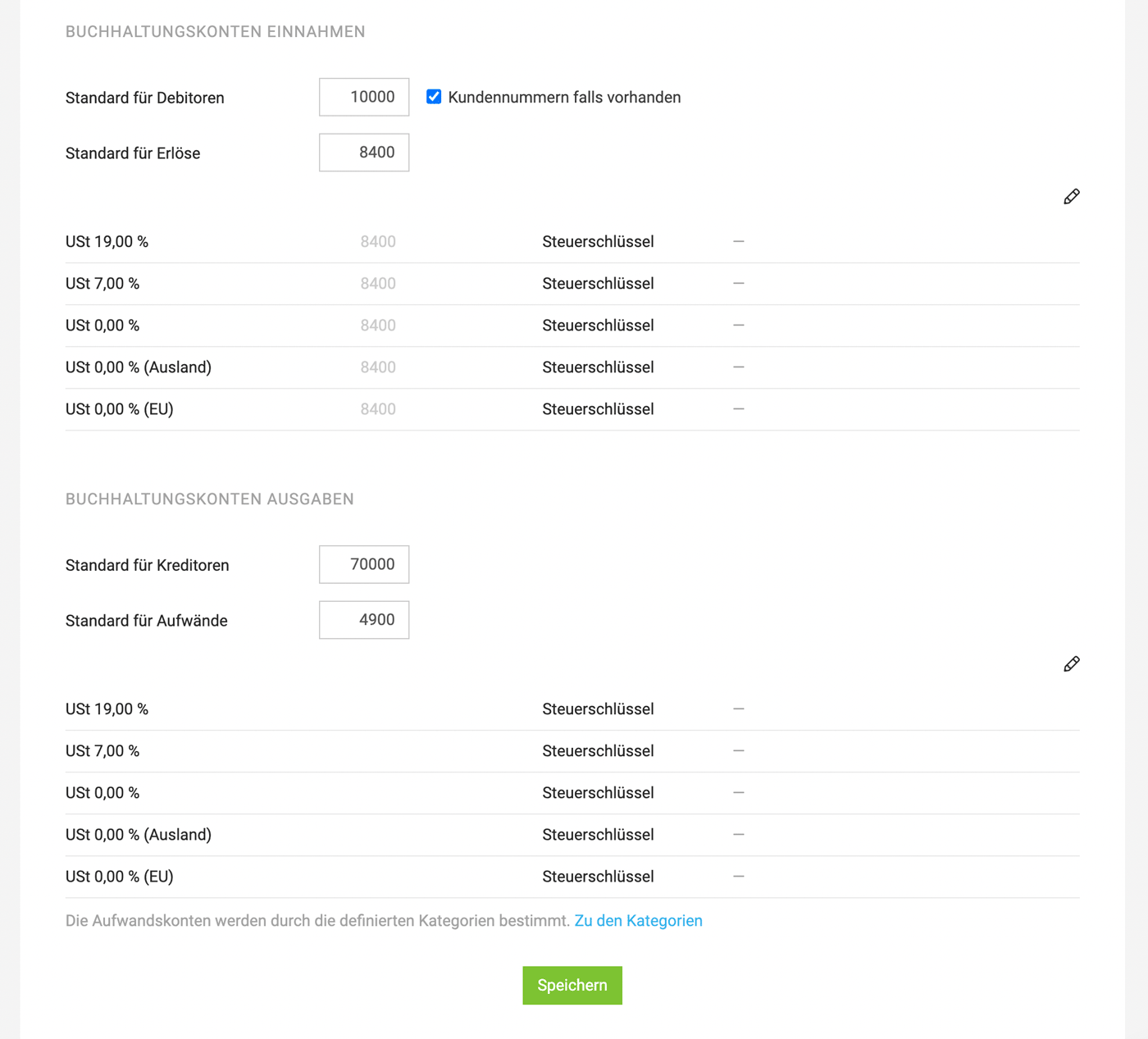

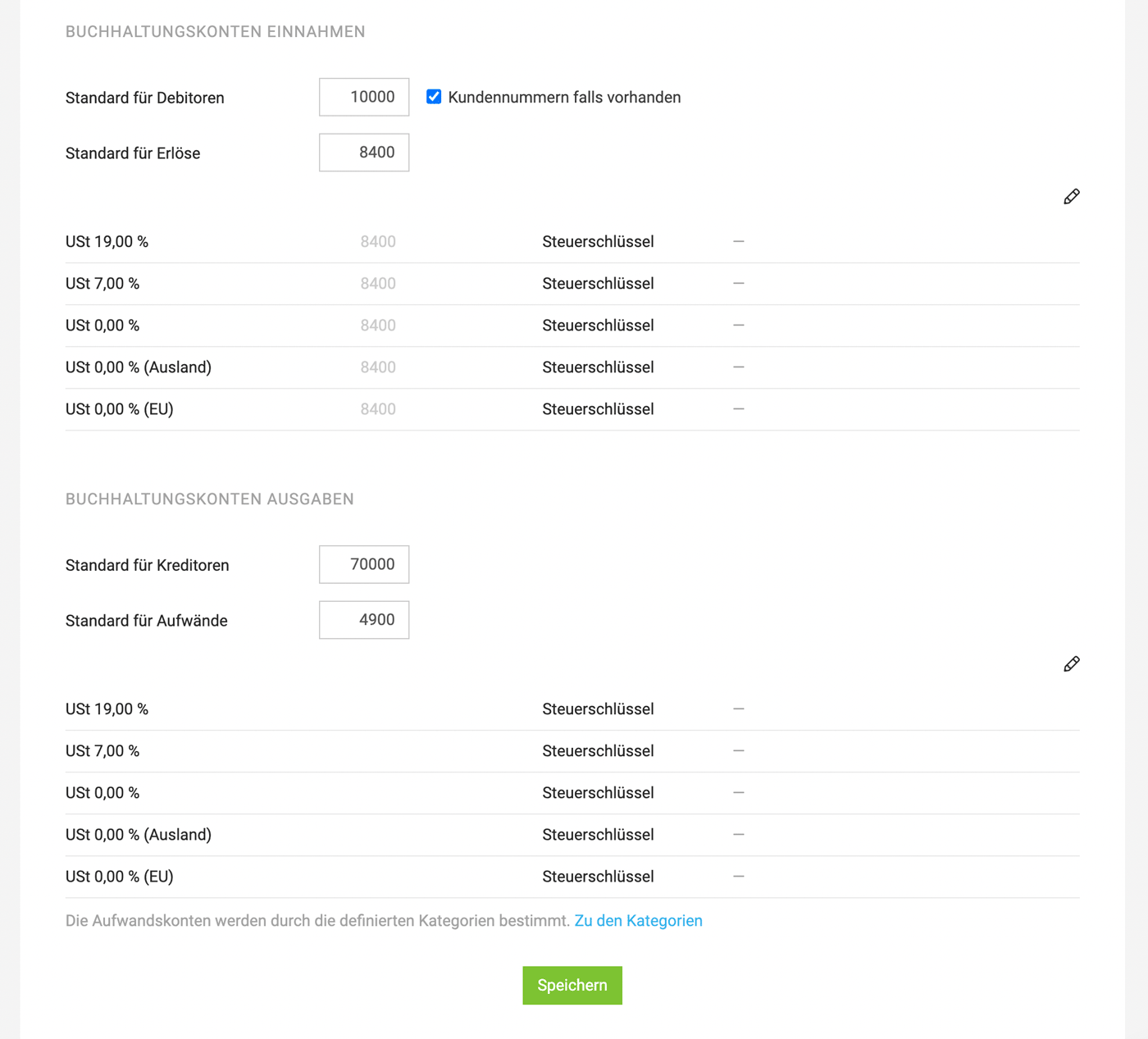

Under "General," you enter the default accounts that should act as a fallback.

Default Debtors

Default Debtors

If you select "Client numbers if available," the client number is set as the default. The client number can be managed automatically or manually.

Revenue Accounts / Tax Codes

Enter accounts and codes for the tax rates.

Revenue Accounts / Tax Codes

Enter accounts and codes for the tax rates.

Important to prevent taxes from being mistakenly applied when the tax rate is 0%

(English image not yet available)

(English image not yet available)

(English image not yet available)

(English image not yet available)Accounts Receivable

Settings > Accounting > Accounts Receivable

Getting Started & Standards

Activate the accounting section under "General". Only then will you be prompted with accounts receivable details in MOCO.

Select the default account under "General". This can always be overridden.

Import MOCO account numbers to get started

This can be done via the company import

Import MOCO account numbers to get started

This can be done via the company import

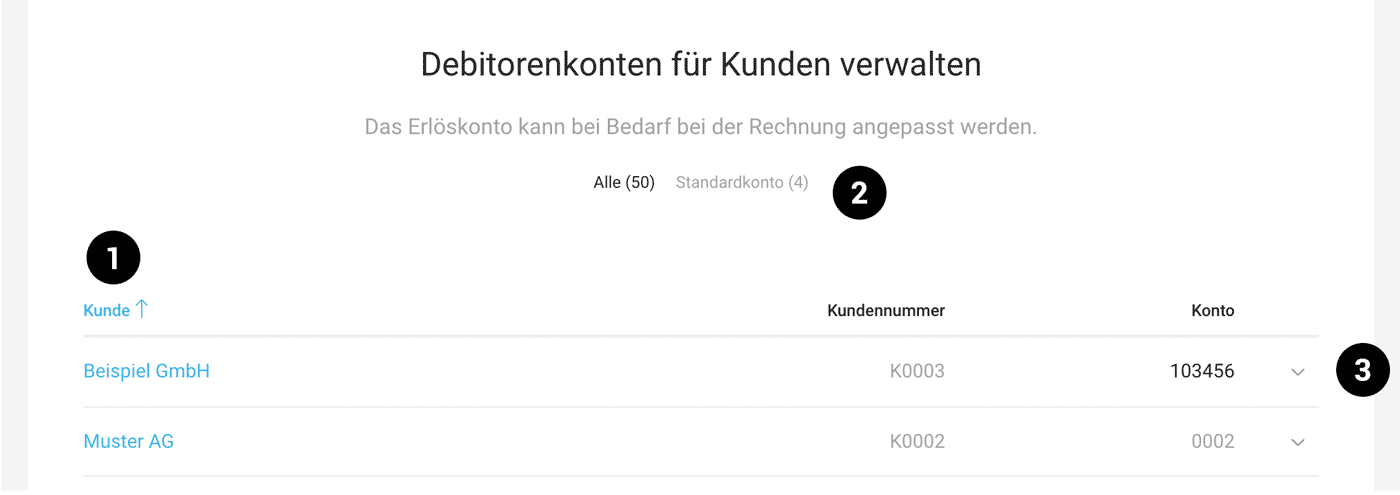

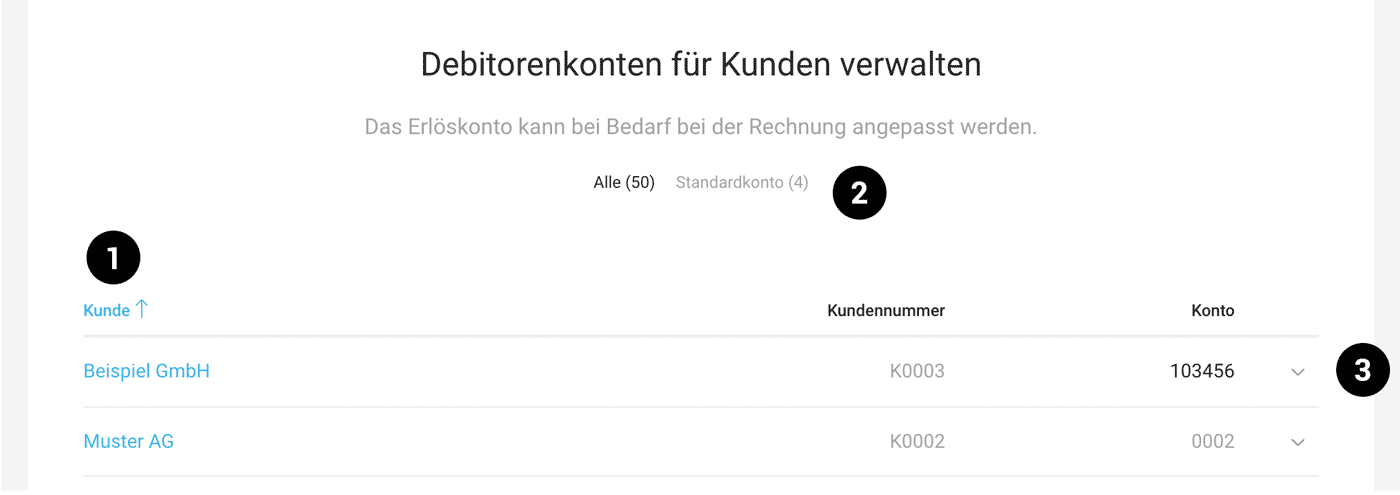

Account numbers or accounts receivable can be managed or changed here in the settings and in three other locations

1. With the Client

Directly when creating the supplier or later via "Edit" (note the blue link "More options").

2. In the Accounting Section (Billing > Accounting > Accounts)

Here you have the list mirrored from the settings. By clicking on the "Default Account" filter (2), you can see which clients still have the set default account as a fallback (see above). The list is also sortable in ascending and descending order (1). This makes it easy to quickly identify which accounts receivable might still be missing. They can be set directly here by double-clicking on "Account" (3).

(English image not yet available)

(English image not yet available)

3. Directly before the accounting export

Note: This change is only saved for the specific purchase and does not set the number for the client.

Directly when creating the supplier or later via "Edit" (note the blue link "More options").

2. In the Accounting Section (Billing > Accounting > Accounts)

Here you have the list mirrored from the settings. By clicking on the "Default Account" filter (2), you can see which clients still have the set default account as a fallback (see above). The list is also sortable in ascending and descending order (1). This makes it easy to quickly identify which accounts receivable might still be missing. They can be set directly here by double-clicking on "Account" (3).

(English image not yet available)

(English image not yet available)3. Directly before the accounting export

Note: This change is only saved for the specific purchase and does not set the number for the client.

Creditors

Settings > Accounting > Creditors

Start & Standards

Enter Default Account

Select the default account under Accounting > General, which will be automatically set when no supplier is chosen for an expenditure (= Fallback) or if no creditor number is recorded for the supplier.

Import Creditor Numbers when Starting with MOCO

This can be done via the Company Import

Select the default account under Accounting > General, which will be automatically set when no supplier is chosen for an expenditure (= Fallback) or if no creditor number is recorded for the supplier.

Import Creditor Numbers when Starting with MOCO

This can be done via the Company Import

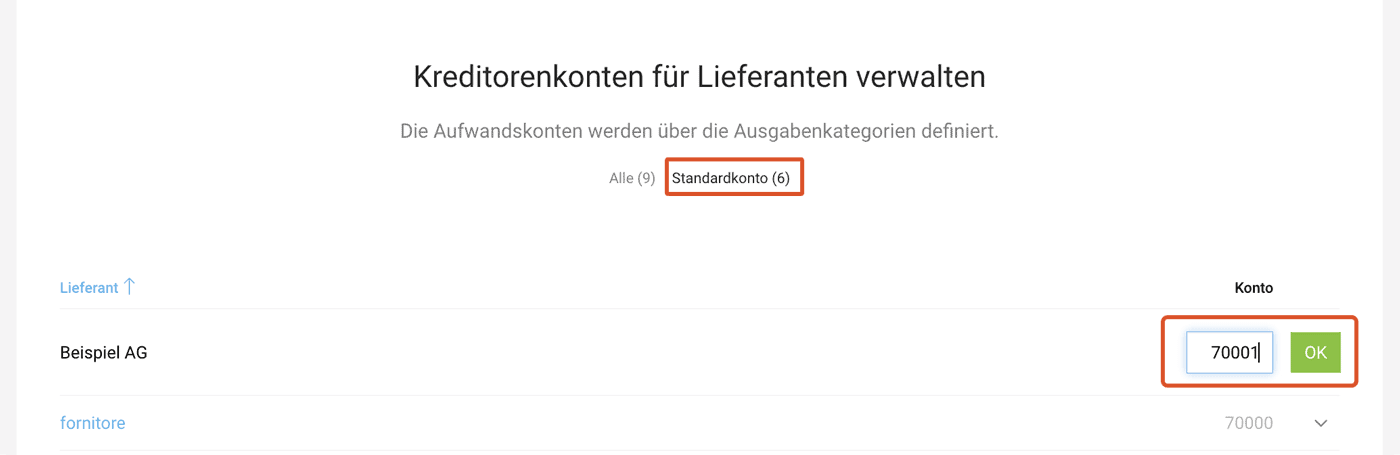

Creditor numbers or accounts can be managed or changed here in the settings and in three other places

MOCO assumes that creditor numbers are assigned outside of MOCO – usually through accounting. They can be entered directly when creating a supplier or set later. Creditor numbers can be manually managed in the following places:

1. At the Supplier

Directly when creating the supplier or later via "Edit" (note the blue link "More Options").

2. In the Accounting Area (Expenditures > Accounting > Accounts)

Here you have the list mirrored from the settings. By clicking on the "Default Account" filter, you can see which suppliers still have the set default account as a fallback (see above). The list can also be sorted in ascending or descending order. This allows you to quickly find out which creditor accounts may still be missing. They can be set directly here by double-clicking on "Account".

(English image not yet available)

(English image not yet available)3. Directly before Export

As a last option, you can overwrite the numbers directly in the list before export. Note: This change is only saved for the specific expenditure and does not set the number for the supplier.

Automatically Assign Creditor Numbers

Please contact us if you would prefer this option – a larger demand will directly influence further development.

Revenue

Settings > Accounting > Revenue

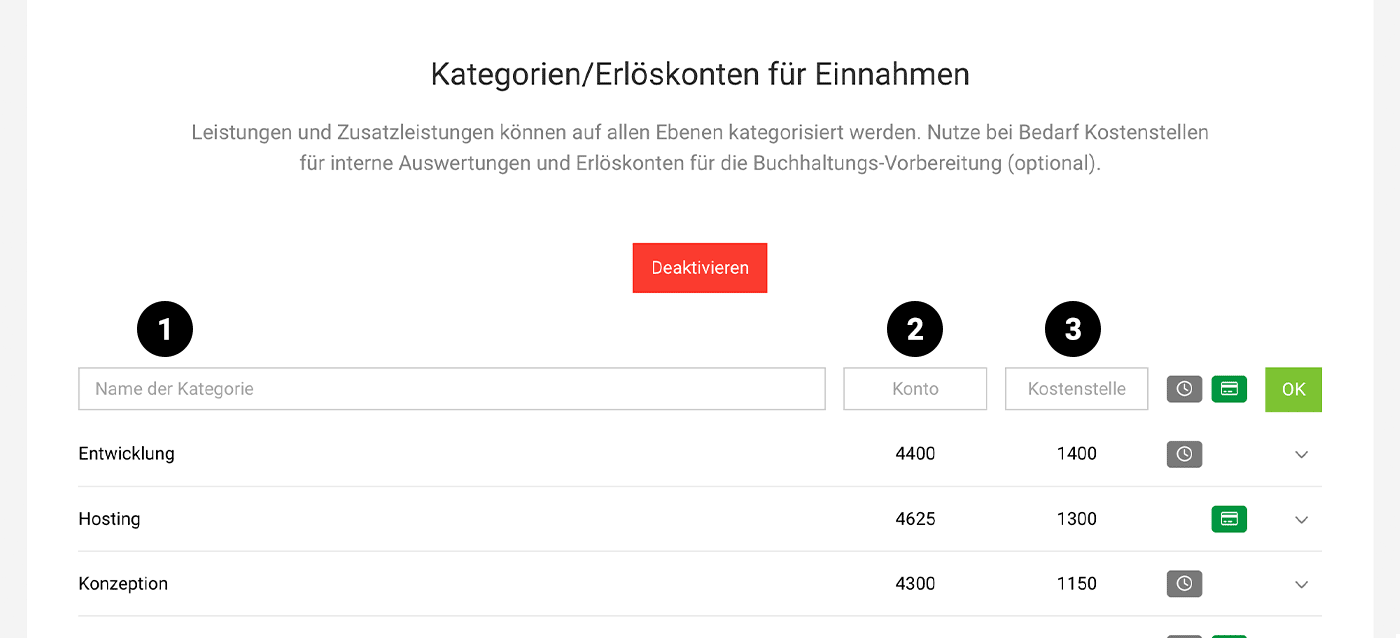

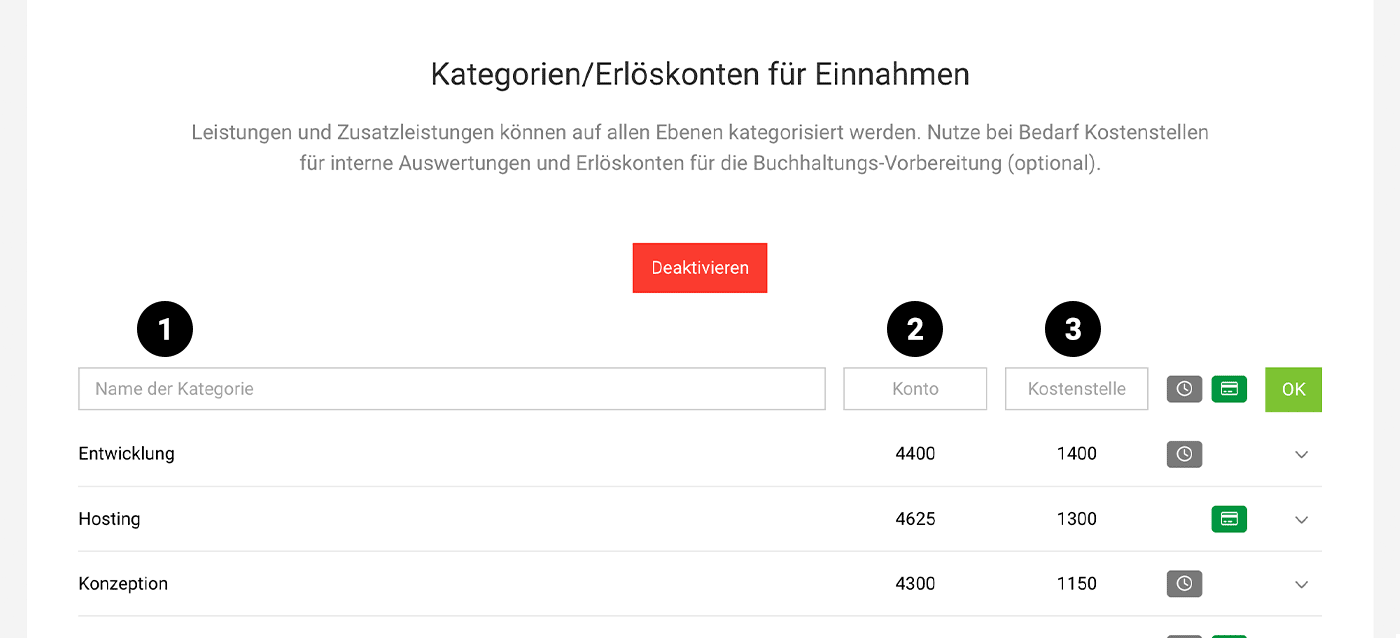

Apply Categories as a Grid across all Services

Your Grid across all Services

You can name services as you wish. They can be renamed in projects or freely defined in quotes, for example. Categories allow you to apply a grid across all services. Through this grid, you can analyse income and, if necessary, pass on cost centres and revenue accounts to accounting.

Activate and Record Categories

Each account can decide how to use the categorisation of services after activating the option, or which of the three levels are relevant for their own company.

Assign to Services

You assign the stored categories to services via the icon label. The assignment can be made anywhere and, once assigned, carries through to the invoice. It can also be overwritten at any step up to the invoice if needed.

(English image not yet available)

(English image not yet available)

Assign to Services

You assign the stored categories to services via the icon label. The assignment can be made anywhere and, once assigned, carries through to the invoice. It can also be overwritten at any step up to the invoice if needed.

(English image not yet available)

(English image not yet available)Category

Categories (1) can be defined without further details. This allows you to easily analyse income by category (also possible via regular invoice export without using the accounting area).

DATEV: Invoice items are grouped by category, and a booking record is created for each. This can be tracked in MOCO under "Billing" > "Accounting" via the tooltip:

.png) (English image not yet available)

(English image not yet available)

DATEV: Invoice items are grouped by category, and a booking record is created for each. This can be tracked in MOCO under "Billing" > "Accounting" via the tooltip:

.png) (English image not yet available)

(English image not yet available) Account

Decide whether you want to record revenue accounts (2) for preparatory accounting. This is an additional level available to you through the categories for accounting preparation.

DATEV: Stored revenue accounts are included (otherwise the standard account applies).

DATEV: Stored revenue accounts are included (otherwise the standard account applies).

Cost Centre

If you define cost centres for internal controlling, store your cost centres (3) for the categories (1).

DATEV: Stored cost centres can be transferred to KOST1 or KOST2 by selecting the type "Service (Category Cost Centre)". Cost Centre Settings

DATEV: Stored cost centres can be transferred to KOST1 or KOST2 by selecting the type "Service (Category Cost Centre)". Cost Centre Settings

Revenue Account per Invoice

Revenue accounts can also be set per invoice before the accounting export (under Billing > Accounting).

Workaround with Labels:

The labels used to mark/categorise invoices are also available in the accounting area (filtering in the side menu + in manual export).

Workaround with Labels:

The labels used to mark/categorise invoices are also available in the accounting area (filtering in the side menu + in manual export).

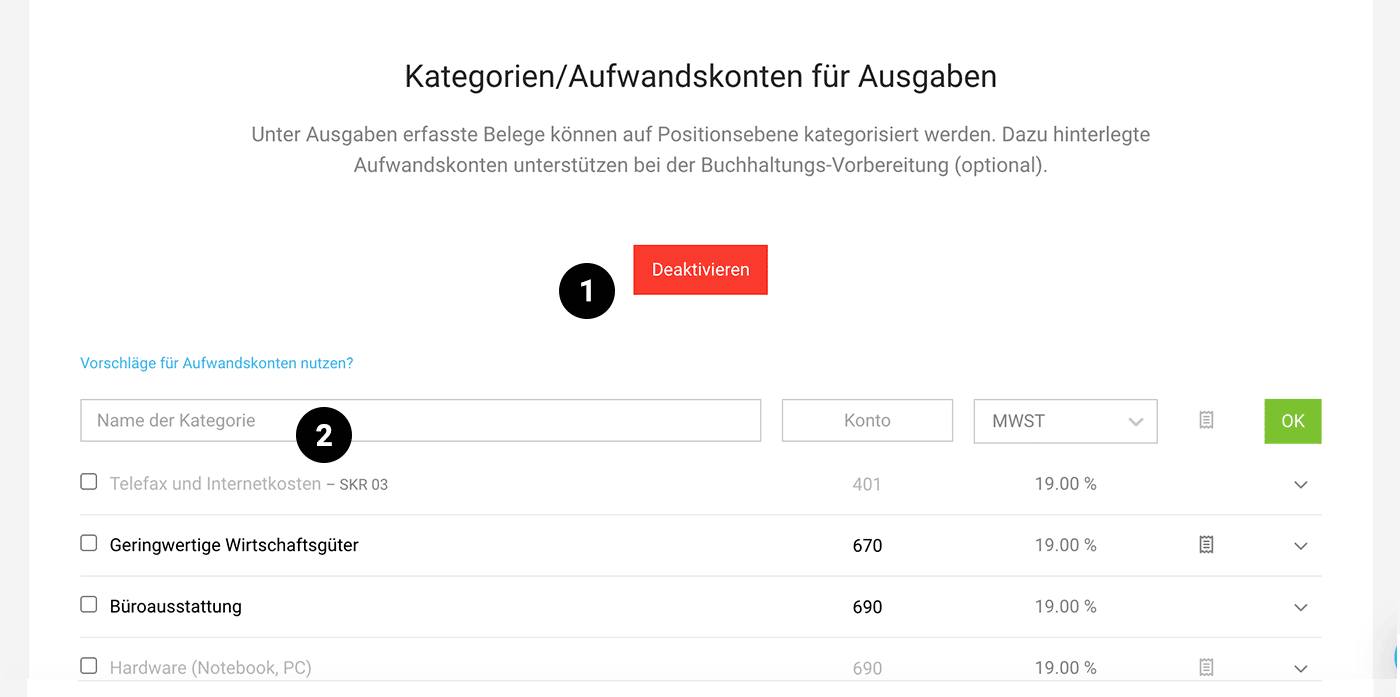

Expenditures

Categorise Expenditure Items & Assign Expense Accounts

Settings > Accounting > Expenditures

Analyse by Category

Receipts recorded under Expenditures can be categorised at the item level and analysed by category. However, the item level is generally more relevant for accounting expense accounts. For straightforward analysis at the expenditure level and cost centres, we recommend using Budgets.

The fallback is always "Standard for Expenditures"

Analyse by Category

Receipts recorded under Expenditures can be categorised at the item level and analysed by category. However, the item level is generally more relevant for accounting expense accounts. For straightforward analysis at the expenditure level and cost centres, we recommend using Budgets.

The fallback is always "Standard for Expenditures"

In the settings under Accounting > General, you select the default account that is set when no expense accounts are recorded.

Activate and Record Categories

After activation (1), you record the categories (2) and, if needed, can fill in account suggestions (e.g., SKR 03 or SKR 04) via the blue link "Use suggestions for expense accounts?". The chosen standard tax rate is automatically preselected when a category is chosen.

Activate and Record Categories

After activation (1), you record the categories (2) and, if needed, can fill in account suggestions (e.g., SKR 03 or SKR 04) via the blue link "Use suggestions for expense accounts?". The chosen standard tax rate is automatically preselected when a category is chosen.

(English image not yet available)

(English image not yet available)Cost Centres

Excel Export under "Invoices" (without DATEV)

With the activated categories for revenues and assigned cost centres, you can utilise the export of invoice line items under "Invoicing" (columns "Category", "Cost Centre" and "Revenue Account"). In Excel, you can aggregate and analyse the invoice items by type.

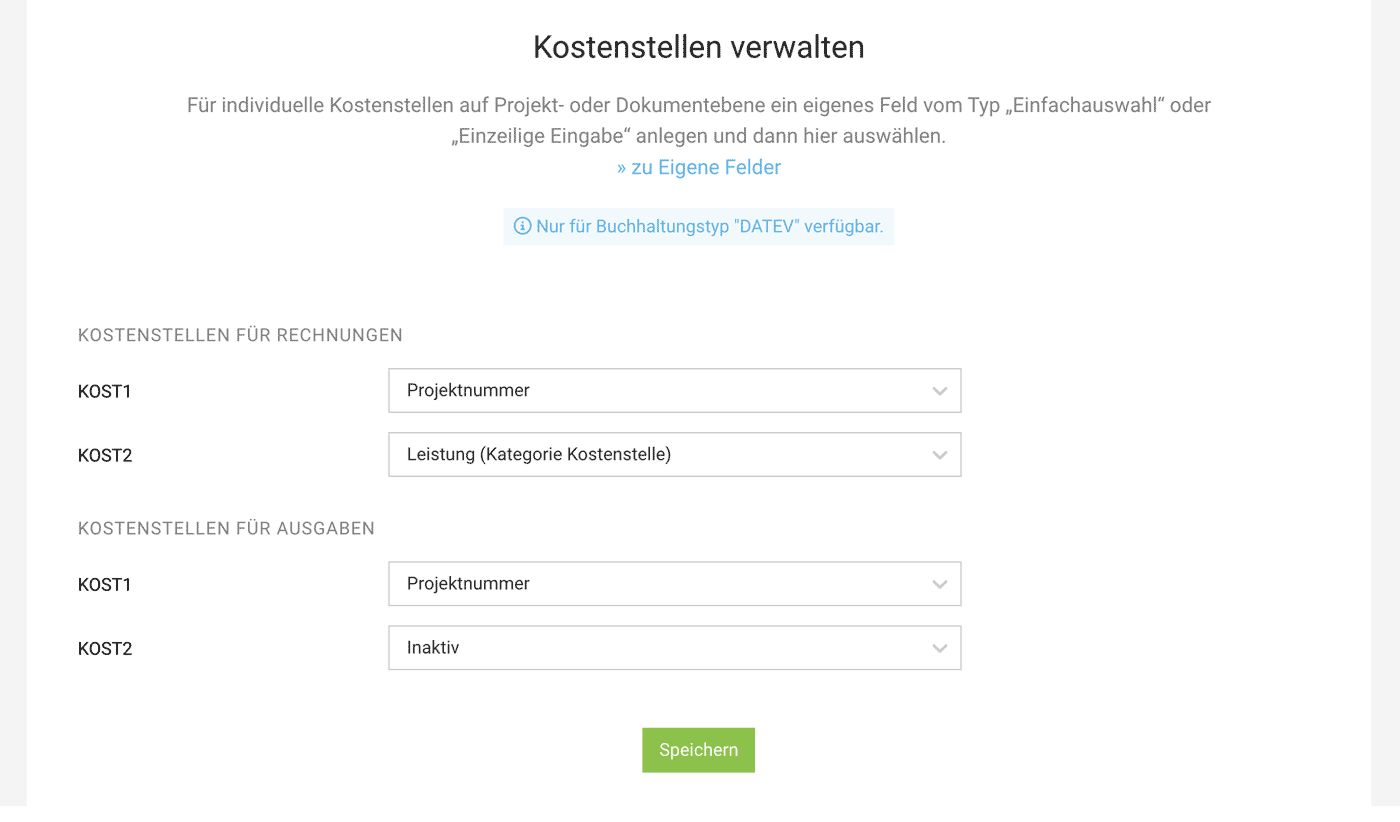

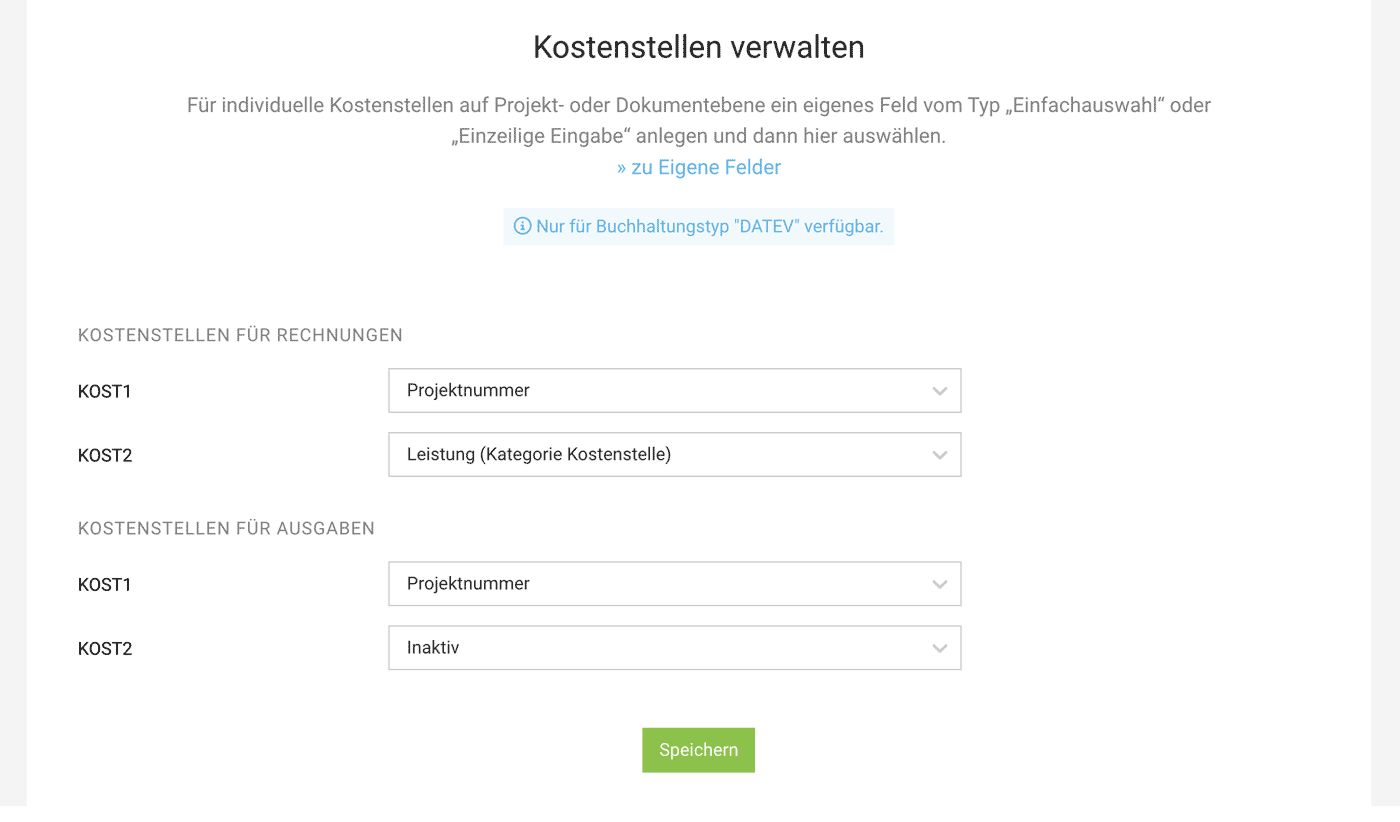

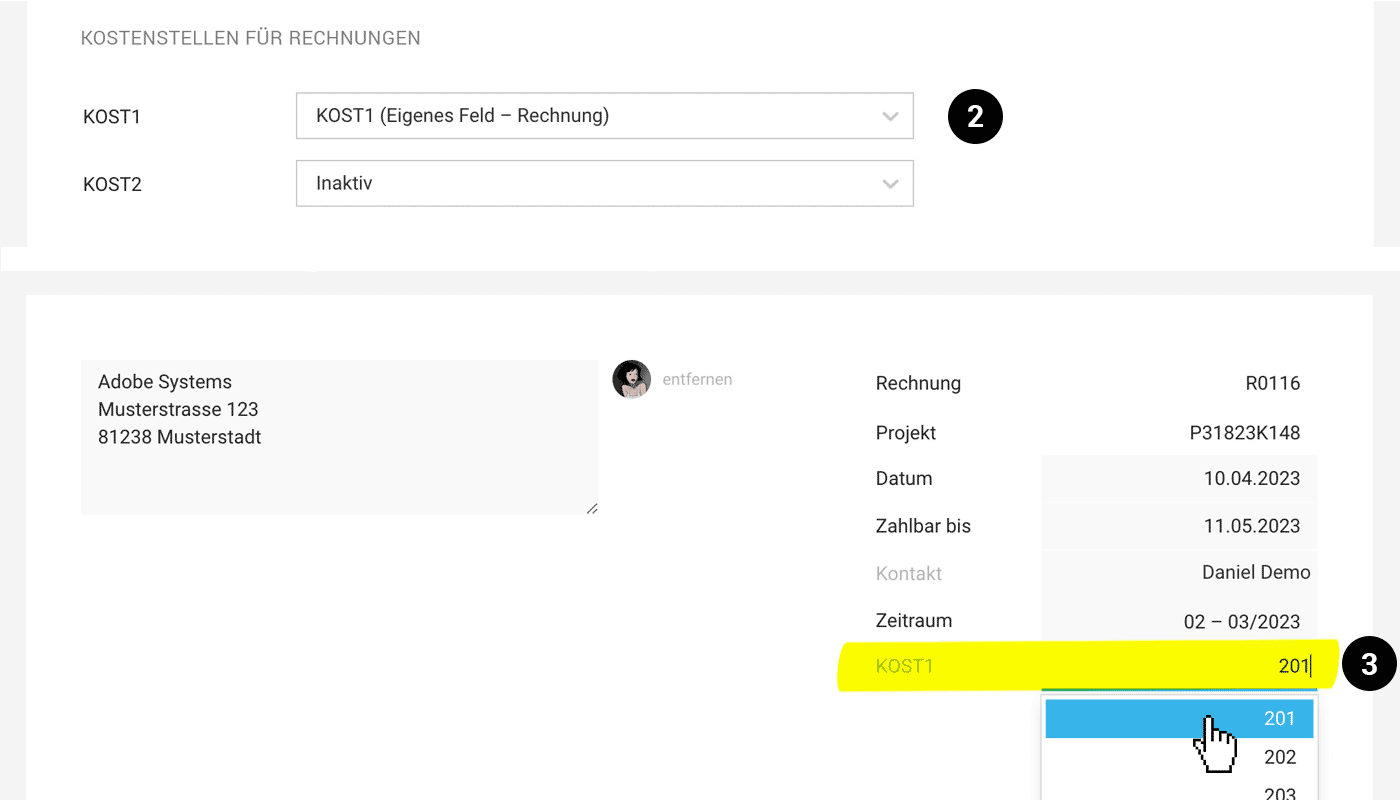

Cost Centres for DATEV

Settings > Accounting > Cost Centres

For KOST1 and KOST 2, you can choose which details are to be transferred to DATEV:

(English image not yet available)

(English image not yet available)

(English image not yet available)

(English image not yet available)Outgoing Invoices

a) Services/Invoice Items The assigned cost centres you define here: Settings > Accounting > Revenues

b) Project Number Is transferred if the invoice was created directly for the project.

b) Project Number Is transferred if the invoice was created directly for the project.

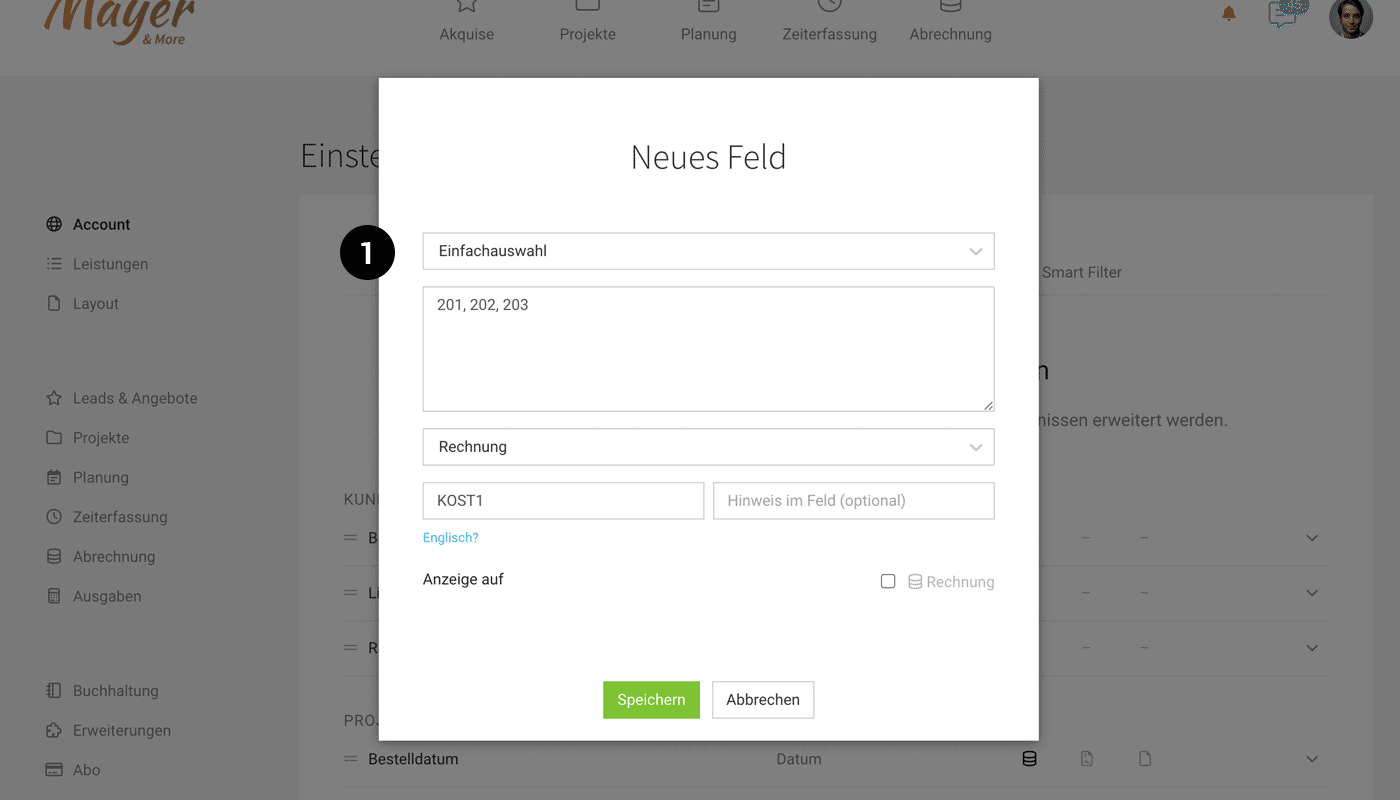

c) Individual Control via Custom Fields Through a custom field (type Single Selection or Single Line Entry) on Project or Invoice.

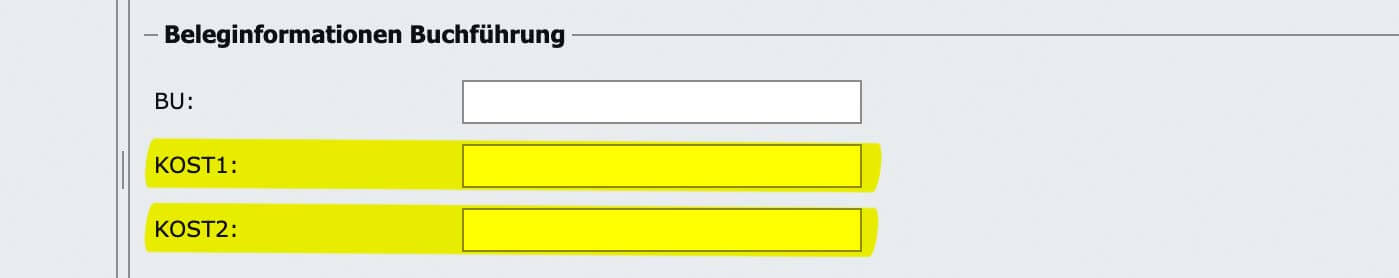

Example for c) Define individual cost centres through a custom field (1). The field can then be selected in the settings via the dropdown for mapping (2). When you select the desired cost centre at the destination (3), it will be transferred with the accounting export.

Example for c) Define individual cost centres through a custom field (1). The field can then be selected in the settings via the dropdown for mapping (2). When you select the desired cost centre at the destination (3), it will be transferred with the accounting export.

(English image not yet available)

(English image not yet available) (English image not yet available)

(English image not yet available)Example image of fields automatically filled in DATEV:

(English image not yet available)

(English image not yet available)Incoming Invoices (Expenditures)

a) Budget Is transferred if budgets with cost centres are defined.

b) Project Number Is transferred if the expenditure item is assigned to a project.

c) Individual Control via Custom Fields Through a custom field (type Single Selection or Single Line Entry) on Project or Expenditure.

c) Individual Control via Custom Fields Through a custom field (type Single Selection or Single Line Entry) on Project or Expenditure.

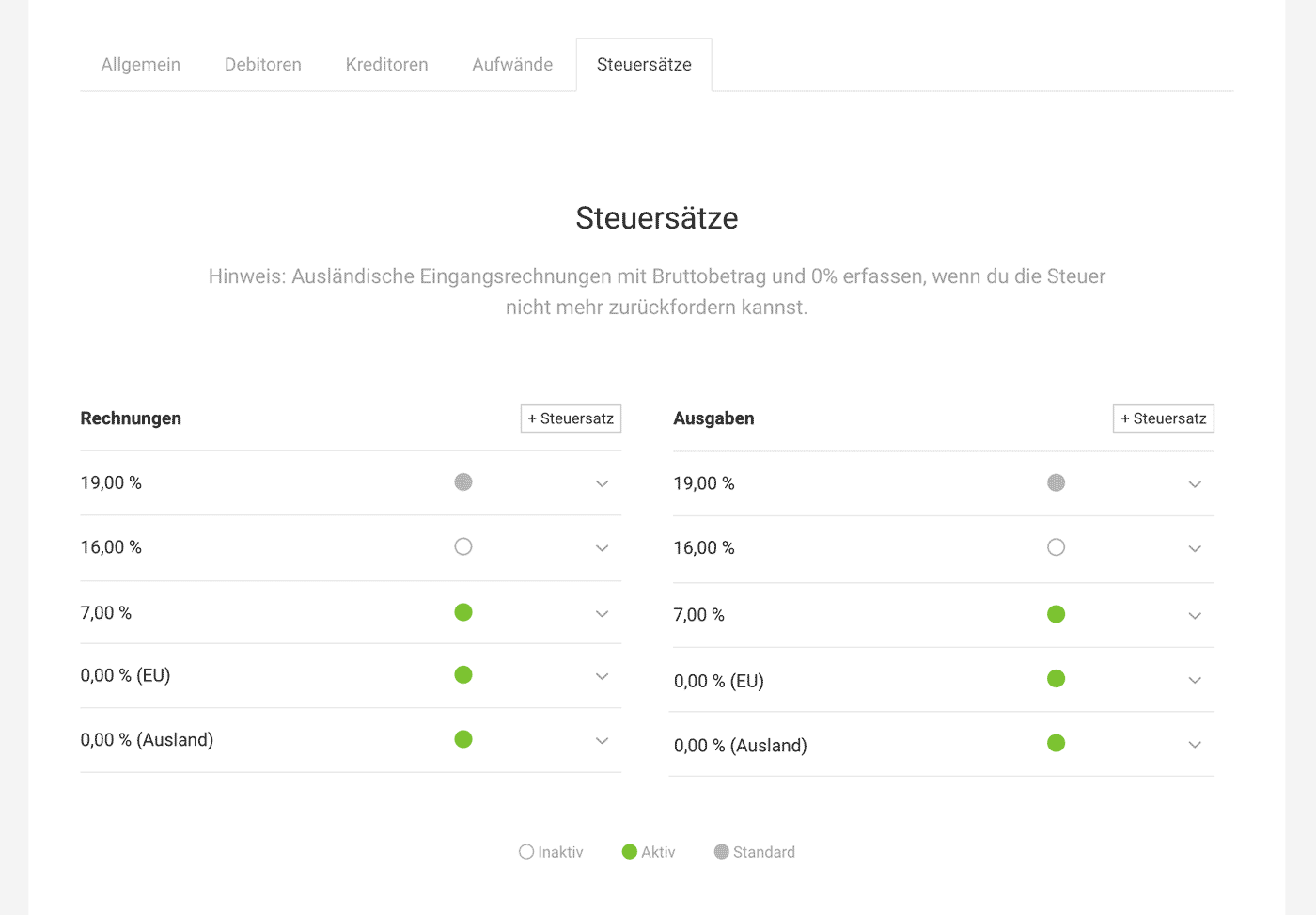

Tax Rates

Settings > Accounting > Tax Rates

Here you will find the tax rates that have been automatically added by MOCO, tailored to the country selected when setting up your account.

Default Tax Rate

A default is pre-selected for incoming and outgoing invoices. You can adjust the default tax rate if needed. It can be modified at any time for the company or directly on the invoice.

Add Additional Tax Rates

Add additional tax rates if your business is also registered in another country.Note: For expenditures from abroad and the EU that include taxes, always record them with a gross amount of 0% (EU) or 0% (abroad) if you cannot reclaim the tax.

Here you will find the tax rates that have been automatically added by MOCO, tailored to the country selected when setting up your account.

Default Tax Rate

A default is pre-selected for incoming and outgoing invoices. You can adjust the default tax rate if needed. It can be modified at any time for the company or directly on the invoice.

Add Additional Tax Rates

Add additional tax rates if your business is also registered in another country.Note: For expenditures from abroad and the EU that include taxes, always record them with a gross amount of 0% (EU) or 0% (abroad) if you cannot reclaim the tax.

(English image not yet available)

(English image not yet available)Small Business Owners

If you are a small business owner and therefore exempt from taxes, select the 0% tax rate. You can also enter a standard disclaimer (e.g., for Germany "According to § 19 UStG, no VAT is charged") that will automatically appear on each invoice – and optionally hide the lines Tax and Gross completely. Ensure the legally correct text with your tax advisor.

Invoices Abroad

For your invoice recipients (i.e., clients) abroad, the tax rate is usually pre-selected correctly. You can also enter a standard disclaimer (e.g., "Reverse charge" or "VAT due to the recipient") that will automatically appear on each invoice – and optionally hide the lines Tax and Gross completely. Ensure the legally correct text with your tax advisor.