Exports & Accounting

Excel Export + Receipts | Accounting Export | Transmission | Edit Export RetrospectivelyExcel Export + Receipts

An export option for invoice data and receipts is standard in every account. By enabling the accounting option in the settings, you can create a targeted accounting export in an additional submenu (see next chapter).

Invoice Data (Excel) and Receipts (PDFs)

MOCO offers filtered incoming invoices as Excel exports and a batch download of receipts at the top right. Access the filter in the inbox with the keyboard shortcut "F" – or click the icon at the top right.

(English image not yet available)

(English image not yet available)

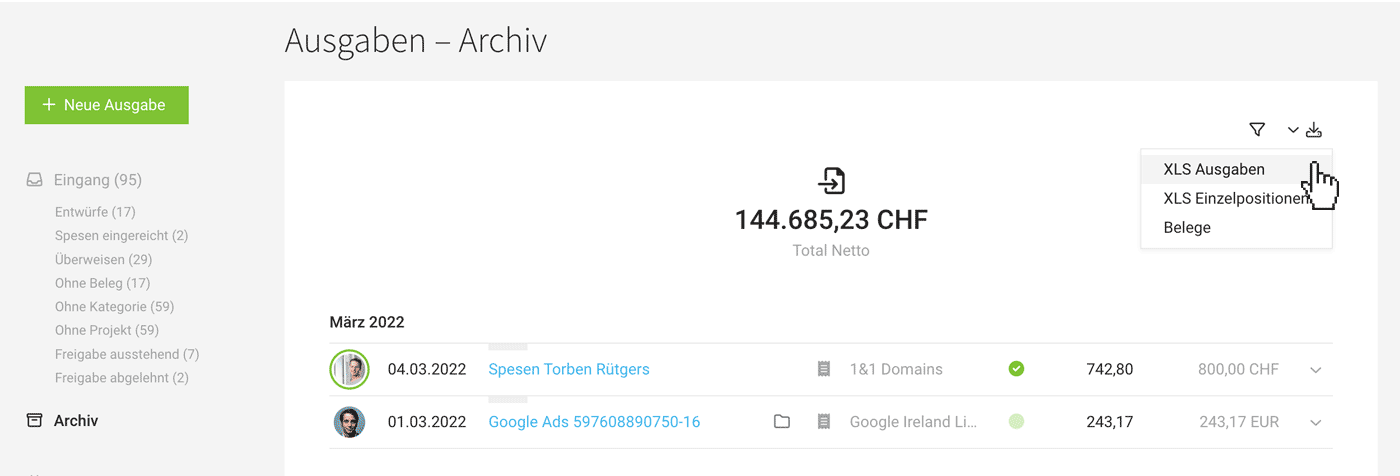

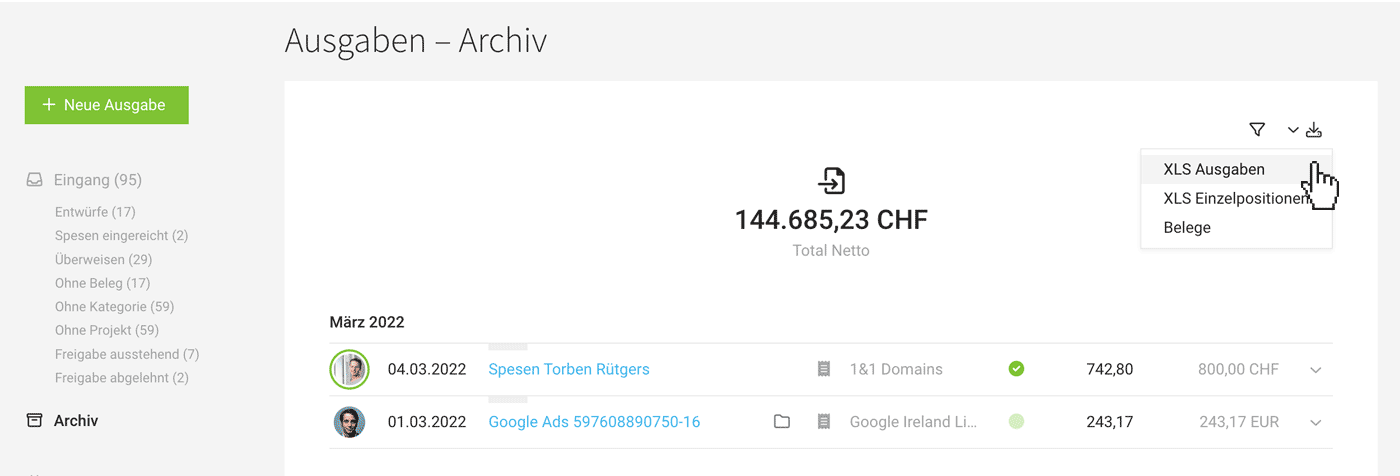

Once invoices in the inbox are processed, move them to "Archive." Typically, you use the export option under "Archive" (see illustration).

Further exports on expenditures – e.g., budgets

(English image not yet available)

(English image not yet available)Once invoices in the inbox are processed, move them to "Archive." Typically, you use the export option under "Archive" (see illustration).

Further exports on expenditures – e.g., budgets

Accounting Export

MOCO bridges the gap to accounting with its accounting section. Incoming invoices can be pre-accounted and sent to the accounting department. This not only allows for synchronized management of accounting & MOCO but also reduces effort and costs in accounting.

▶️ Tobias from MOCO introduces the activatable accounting in this video

Activation & Setup

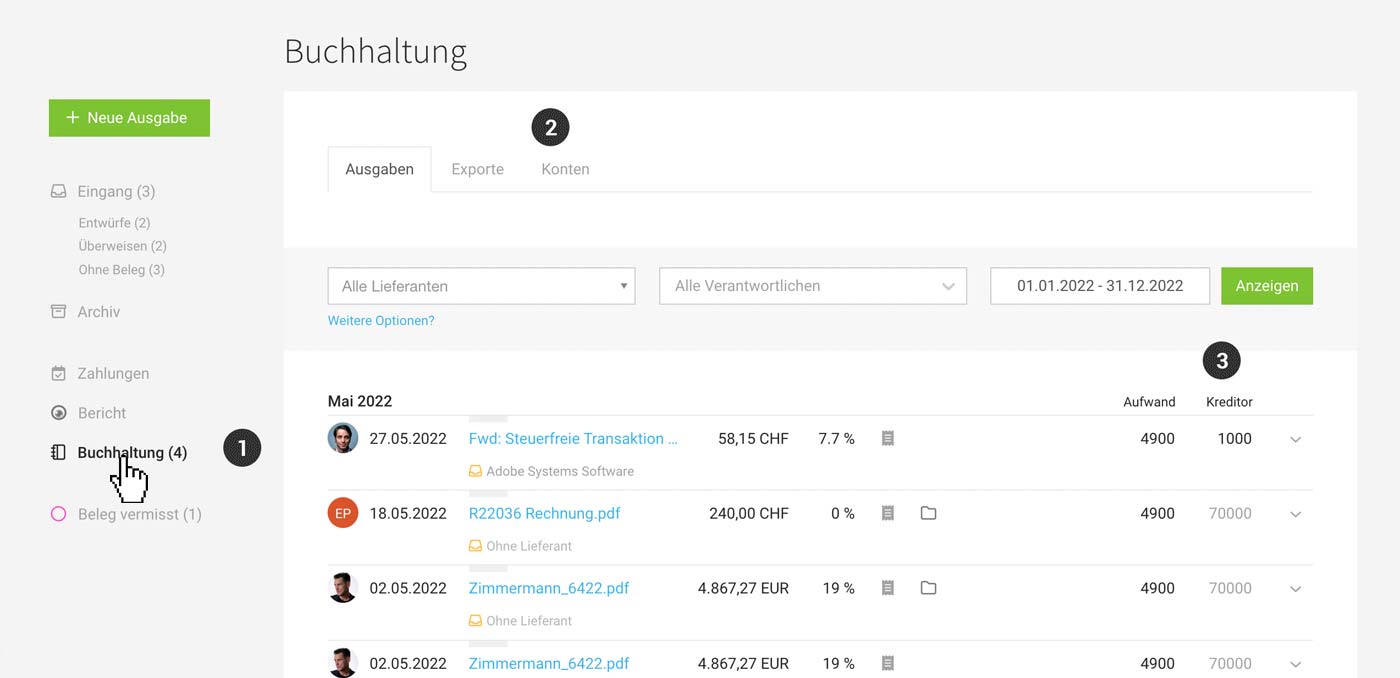

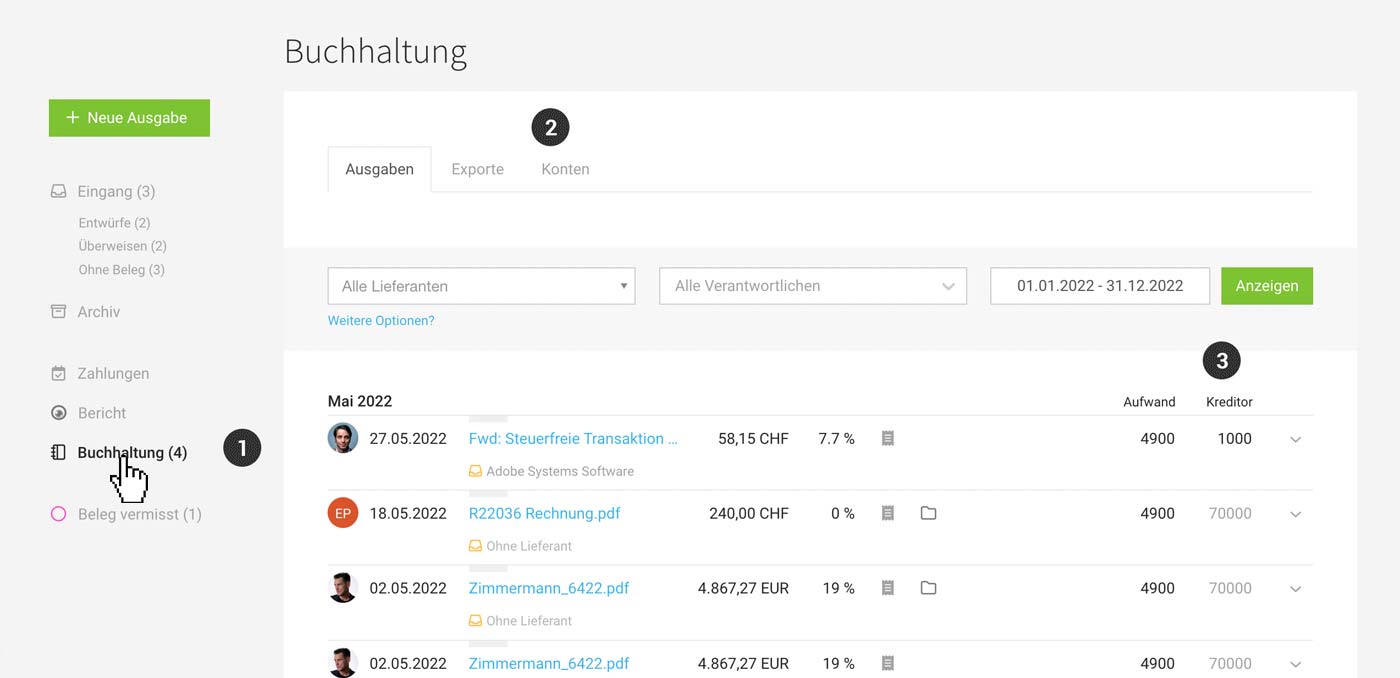

When an accounting option is selected, a new sub-item "Accounting" appears under "Expenditures" (1).

Before an export is performed, accounts should be set up.

» All information on activation and accounting accounts

Before an export is performed, accounts should be set up.

» All information on activation and accounting accounts

Prepare and Export Incoming Invoices

A monthly export is generally recommended. However, individually selected incoming invoices can also be exported.

Proceed monthly as follows:

1. At the end of the month, check and complete any outstanding incoming invoices for the month. The Smart Filters assist you with this.

2. Under "Accounting," check accounts in the list (3)

3. Select the invoices for the month and create the export by clicking "Export Invoices."

4. Exported expenditures are no longer listed or selectable under "Accounting." You can find the created export under "Exports" (2). The expenditures related to the export are listed and linked by clicking on the export.

Proceed monthly as follows:

1. At the end of the month, check and complete any outstanding incoming invoices for the month. The Smart Filters assist you with this.

2. Under "Accounting," check accounts in the list (3)

3. Select the invoices for the month and create the export by clicking "Export Invoices."

4. Exported expenditures are no longer listed or selectable under "Accounting." You can find the created export under "Exports" (2). The expenditures related to the export are listed and linked by clicking on the export.

Full Control Over Which Expenditures Have Not Yet Been Exported to Accounting

Under "Accounting," all expenditures that have not yet been exported to accounting are always listed – whether they are still incoming or already archived (= completed).

If you select the checkbox "Archive expenditures afterwards" during export, MOCO automatically moves any incoming invoices still in the incoming section to "Archive."

Exported expenditures are automatically locked – but you have the following options for corrections

(English image not yet available)

(English image not yet available)

If you select the checkbox "Archive expenditures afterwards" during export, MOCO automatically moves any incoming invoices still in the incoming section to "Archive."

Exported expenditures are automatically locked – but you have the following options for corrections

(English image not yet available)

(English image not yet available)Filter and Edit in the List

Creditor account and expense account can also be overwritten directly here in the list by double-clicking.

- "Creditor" refers to the creditor account. Creditors can also be managed additionally in the "Accounts" tab (2).

» More about creditors - Under "Expense", the standard expense account is displayed. Specific expense accounts can be predefined via expenditure categories and assigned to expenditure items as needed.

» More about expense accounts

The labels, with which incoming invoices were marked or categorized, are also available in the accounting section (filter option in the side menu + in manual export).

Transmission

The steps leading up to the export are outlined in the previous section.

The transmission to accounting/tax consulting is carried out manually or automatically, depending on the chosen accounting option.

Manual

MOCO offers various export options, such as in DATEV format, for Abacus, or a neutral format. You can find an overview of all accounting export options here

The export you regularly create covers invoice data and receipts. It is listed under "Exports" with the specified period, and you provide these exports to your tax consultant/accounting department (or assign a person in MOCO who you grant access to expenditures and invoicing).

Custom fields on expenditures (single selection & single-line text input) are included in the generic CSV export.

Custom fields on expenditures (single selection & single-line text input) are included in the generic CSV export.

Automatic Transfer

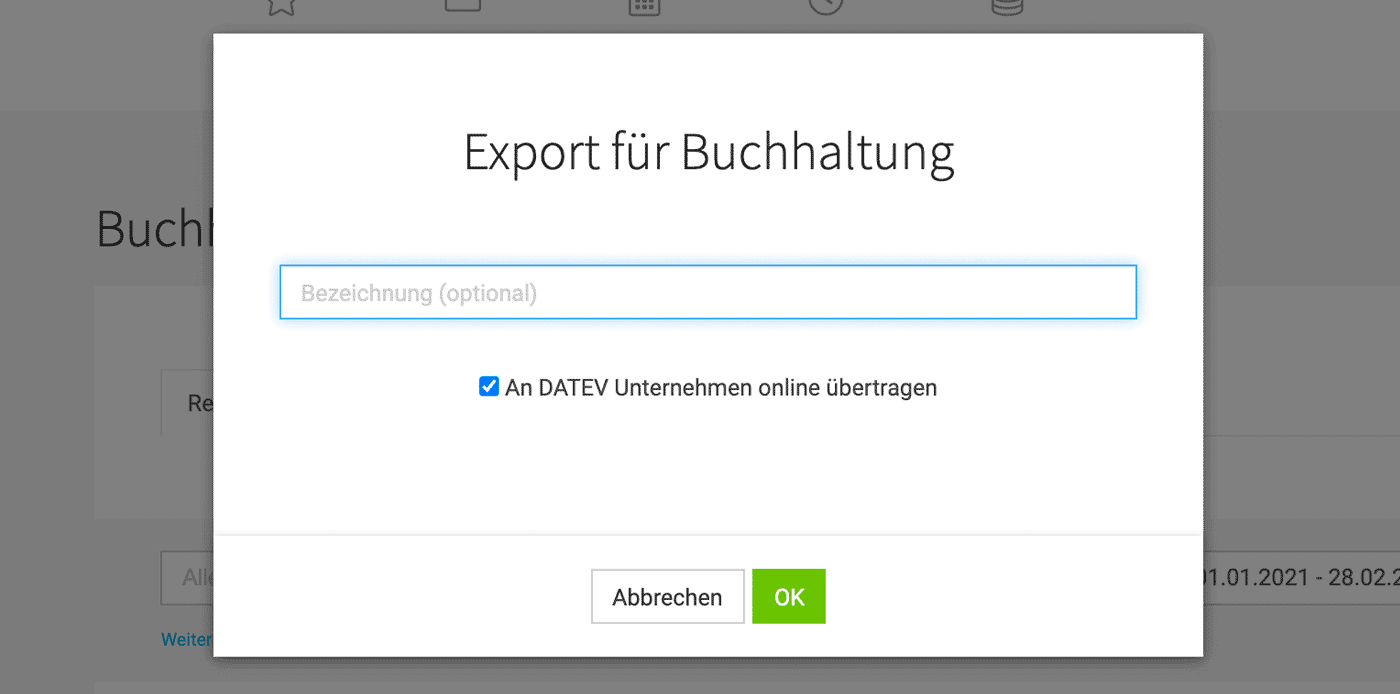

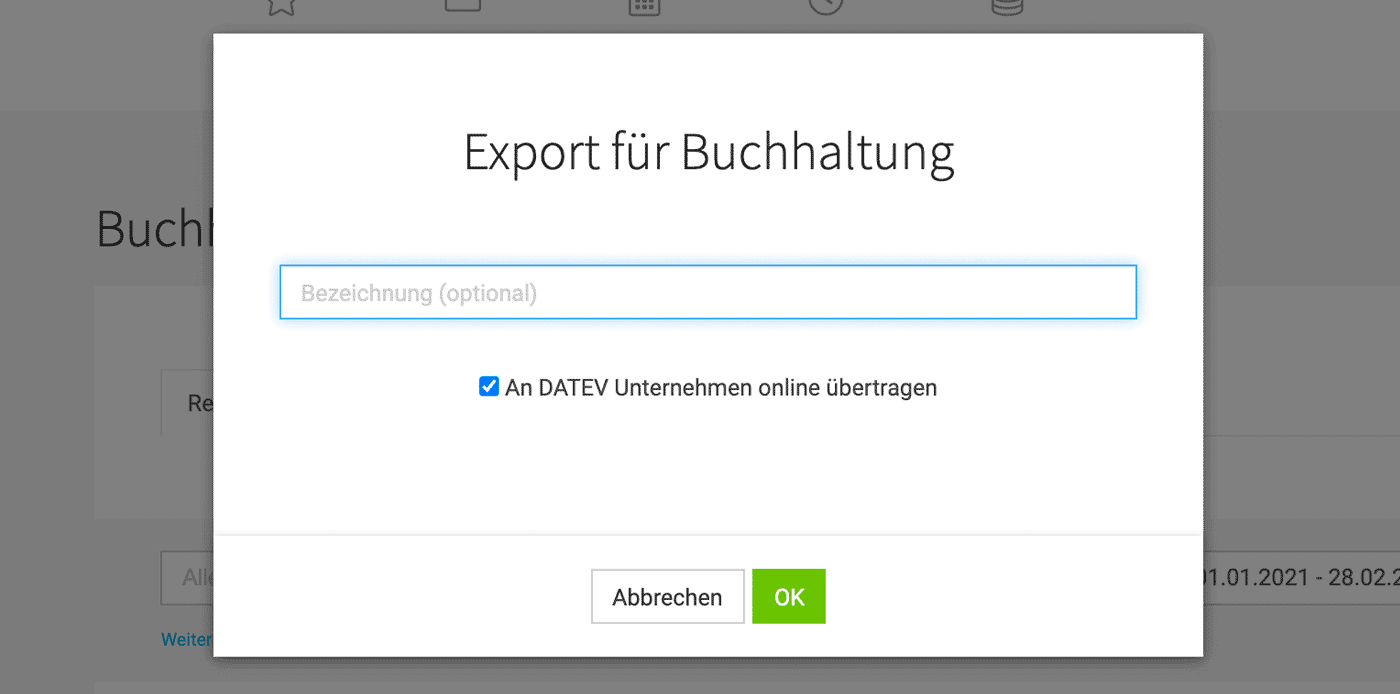

DATEV Unternehmen online (DUO)

Invoice data, including receipts, is directly transferred to DATEV Unternehmen online during the export process with a click. After provisioning, the tax consultant can retrieve and further process the data as booking suggestions.

(English image not yet available)

(English image not yet available)

Incoming invoice receipts with payment methods such as credit card, PayPal, cash, or direct debit are transmitted to DUO with the status paid. This prevents accidental creation of a payment order in DUO.

Assistance with error messages

(English image not yet available)

(English image not yet available)Incoming invoice receipts with payment methods such as credit card, PayPal, cash, or direct debit are transmitted to DUO with the status paid. This prevents accidental creation of a payment order in DUO.

Assistance with error messages

Edit Export Retrospectively

Expenditures exported for accounting are locked to ensure synchronization with the accounting records.

Undo Entire Export

In certain cases, such as after tests, exports can be deleted within 24 hours (or later by the account holder). Exports to DATEV Unternehmen online can only be deleted by the account holder.

Edit or Delete Individual Expenditures Retrospectively

Supplier or Category can be adjusted at any time on the saved view of the expenditures (indicated by blue text hints).

Minimal discrepancies in the amount can be ignored since MOCO, as a business management tool, does not need to match the accounting records to the cent. For example, if an employee has entered an incorrect tax rate on a personal expenses receipt.

In such cases, make the corrections in the accounting records and record a note under the invoice in MOCO for traceability.

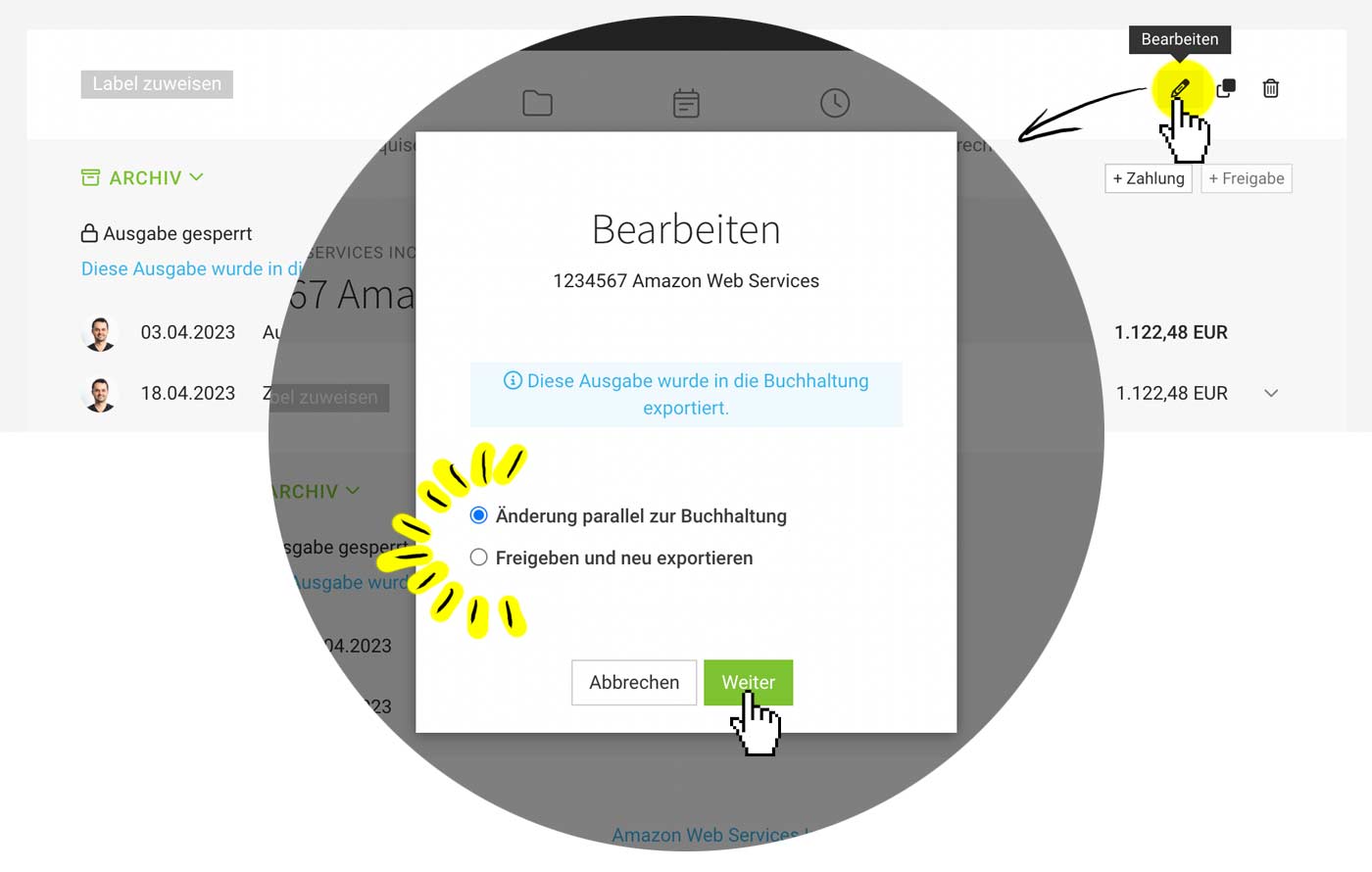

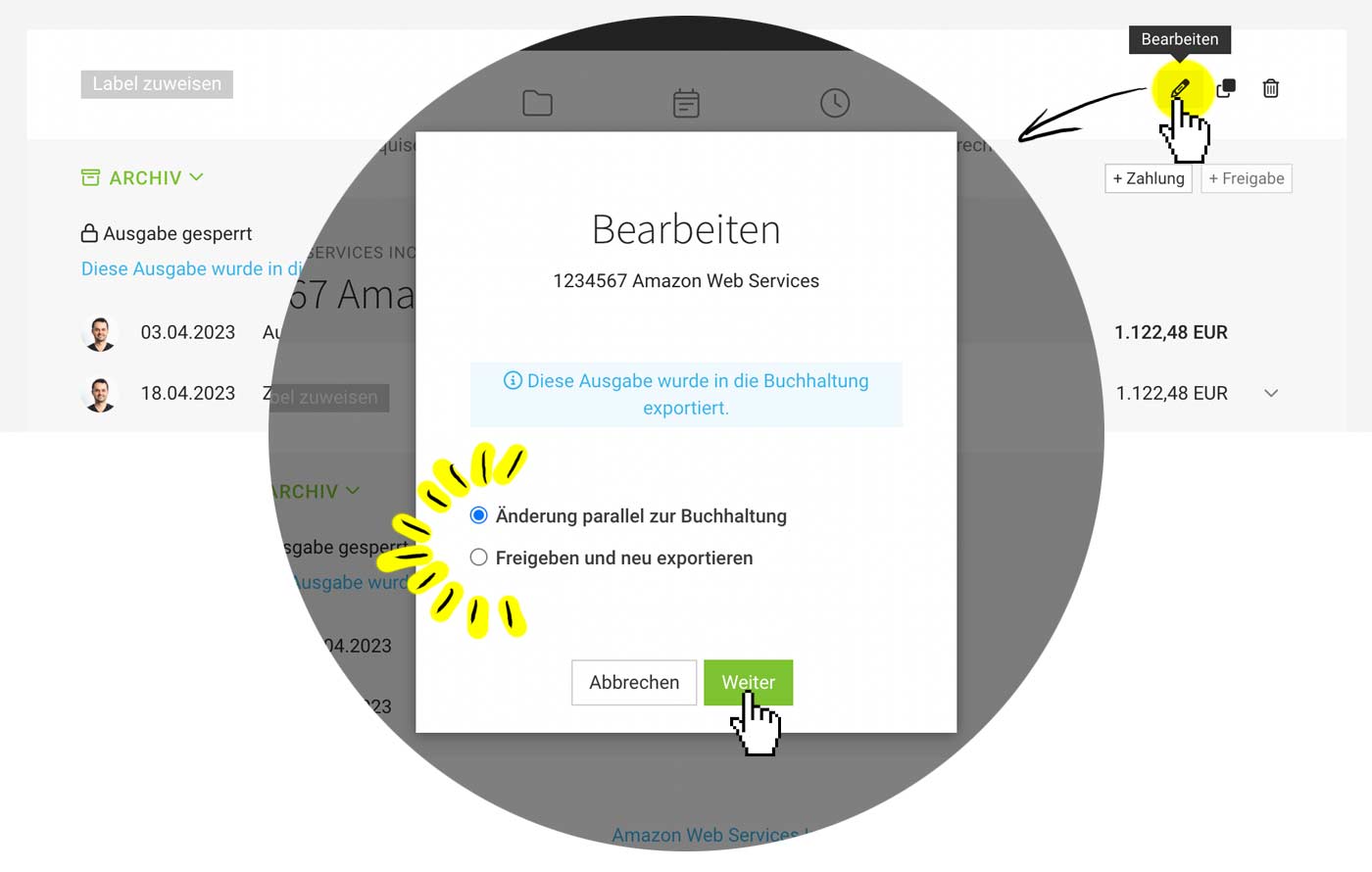

If you wish to adjust an expenditure retrospectively, you can do so as follows:

On the expenditure, select "Edit" (see illustration) to choose whether an adjustment should be made in parallel with the accounting or whether the expenditure should be released and re-exported (or deleted). After saving changes, these will be recorded in the change log, and a note will be created indicating who released and modified the expenditure.

(English image not yet available)

(English image not yet available)

Minimal discrepancies in the amount can be ignored since MOCO, as a business management tool, does not need to match the accounting records to the cent. For example, if an employee has entered an incorrect tax rate on a personal expenses receipt.

In such cases, make the corrections in the accounting records and record a note under the invoice in MOCO for traceability.

If you wish to adjust an expenditure retrospectively, you can do so as follows:

On the expenditure, select "Edit" (see illustration) to choose whether an adjustment should be made in parallel with the accounting or whether the expenditure should be released and re-exported (or deleted). After saving changes, these will be recorded in the change log, and a note will be created indicating who released and modified the expenditure.

(English image not yet available)

(English image not yet available)Notes for Re-export

If invoices are to be re-transferred to DUO: Ensure that the data is also deleted in DUO beforehand to avoid duplicate invoices. The easiest way to do this is by cancelling the import via the import log.

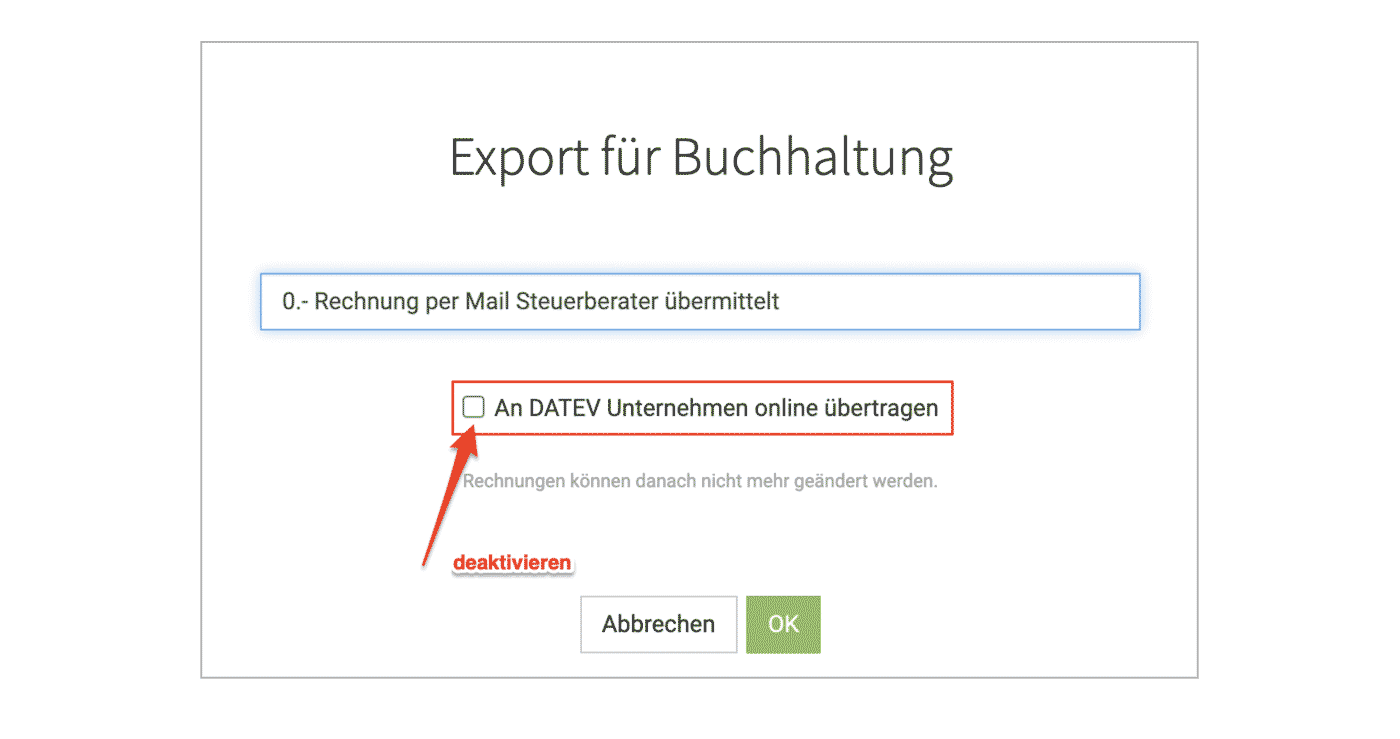

If expenditures are to be exported after editing but NOT transferred: Uncheck the checkbox for DUO transmission in the export dialog:

(English image not yet available)

(English image not yet available)