Customization

Custom Layout | Standards, Variables, Custom Fields | Invoicing Information | Invoice Numbers | Tax Rate & "Reverse Charge" | Delivery NotesCustom Layout

Your Unique Look-and-Feel

With customisable letterhead and numerous formatting options, you can usually adapt to your existing look-and-feel independently.

Detailed information on layout settings

(English image not yet available)

(English image not yet available)

Detailed information on layout settings

(English image not yet available)

(English image not yet available)Bild: Beispiellayouts

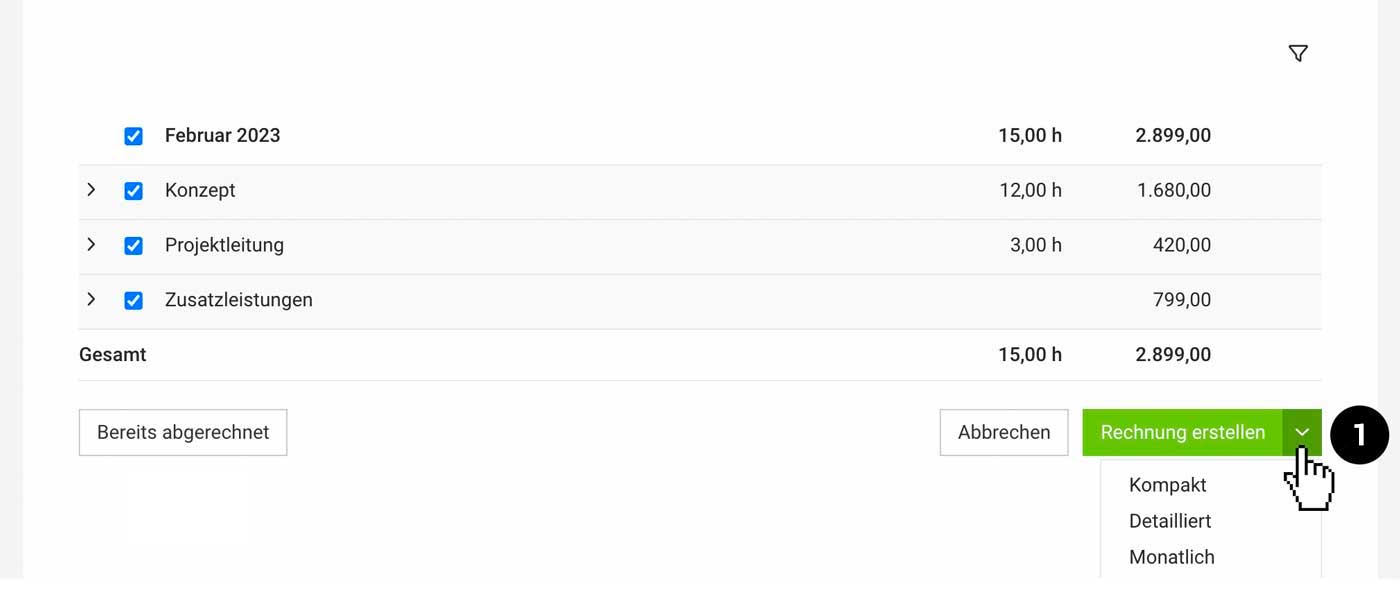

Invoice Structure: Compact, Monthly, Detailed

For billing items, MOCO offers three options:

- Monthly (Grouped by months)

- Detailed (Every single time entry)

- Compact (No grouping by months).

When selecting the "Create Invoice" button (1), MOCO always uses the default defined in the settings – however, this can be preset differently here for project billing.

(English image not yet available)

(English image not yet available)

(English image not yet available)

(English image not yet available)Hourly Rate by Person but Billing by Service

With "Hourly Rate by Person," MOCO automatically breaks down the invoice by person. If you prefer to break down by service, you can choose that here as well.

Standards, Variables, Custom Fields

Define Global Standards

Global standard texts and values for invoices and reminders are predefined in the settings under "Invoicing."

» All information about the settings area

» You are not subject to VAT

» All information about the settings area

» You are not subject to VAT

Define Standards for Clients

For each client, you can define

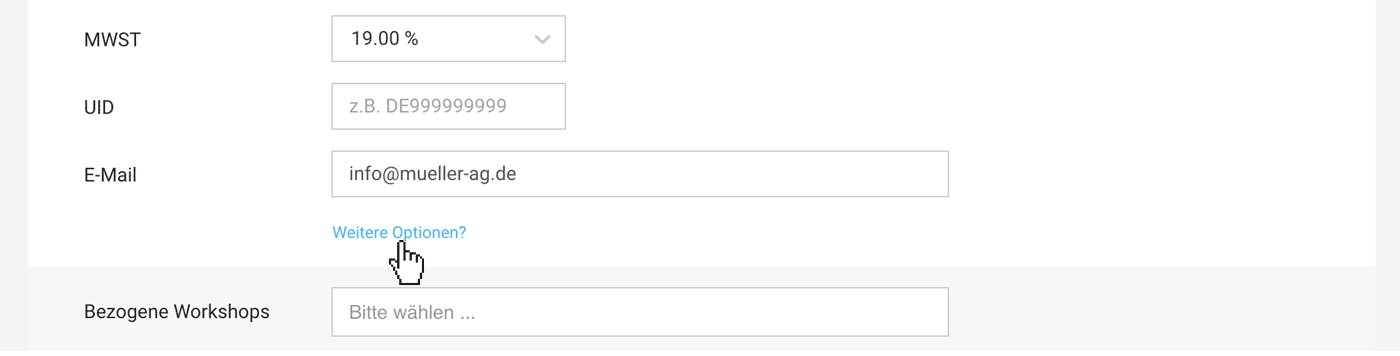

- Billing address, invoice format, invoice email, VAT ID, etc.

- Main currency

- Alternative language for documents and emails

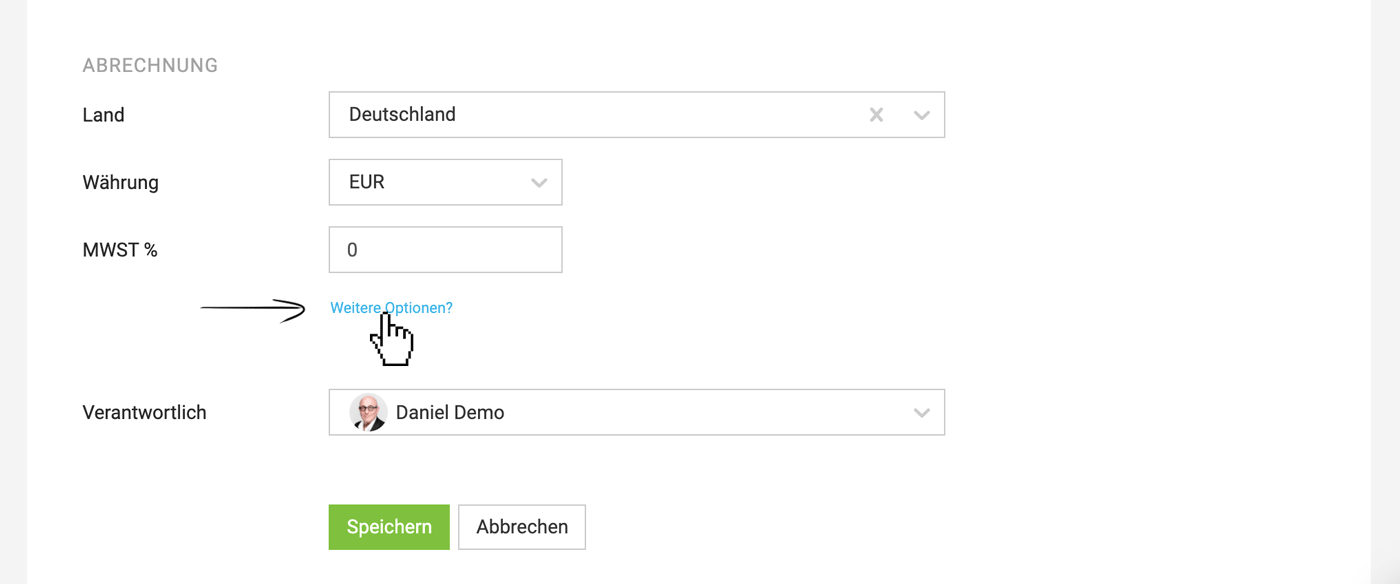

- "Additional Options" (see image): Here you can record additional details such as a different closing text, additional CC email addresses, payment terms and discounts, automatic attachment of timesheets or a custom price list ("Different hourly rates").

- Specific information for invoicing: Can be defined in the client under "Invoicing" or in the form.

(English image not yet available)

(English image not yet available)Define Standards for Projects

- Project currency

- Billing address, email, CC email addresses, timesheet, invoice contact (personalisation): Can be overridden in the project under "Invoicing"

- Specific information for invoicing, that should not be forgotten More about invoicing information

There is also the possibility to make adjustments on the invoice itself.

Variables

In the introductory and closing text as well as email cover letters, you can work with variables at every level. Simply type "{" and all options will be offered by MOCO for insertion.

» How it looks when you call variables with {

» How it looks when you call variables with {

Custom Fields for the Info Block

MOCO suggests typical document details in the info block that can be shown or hidden. Alternatively, MOCO can also display this information via variables (see above) in the introductory or closing text.

These mandatory details are required on an invoice

With Custom Fields, you can enhance or personalise the info block – e.g., with a field for the order number

Custom fields created directly for invoices can also serve an internal purpose only. In that case, do not select the display on the PDF.

These mandatory details are required on an invoice

With Custom Fields, you can enhance or personalise the info block – e.g., with a field for the order number

Custom fields created directly for invoices can also serve an internal purpose only. In that case, do not select the display on the PDF.

Invoicing Information

Use these options for very specific agreements with the client or for a particular project:

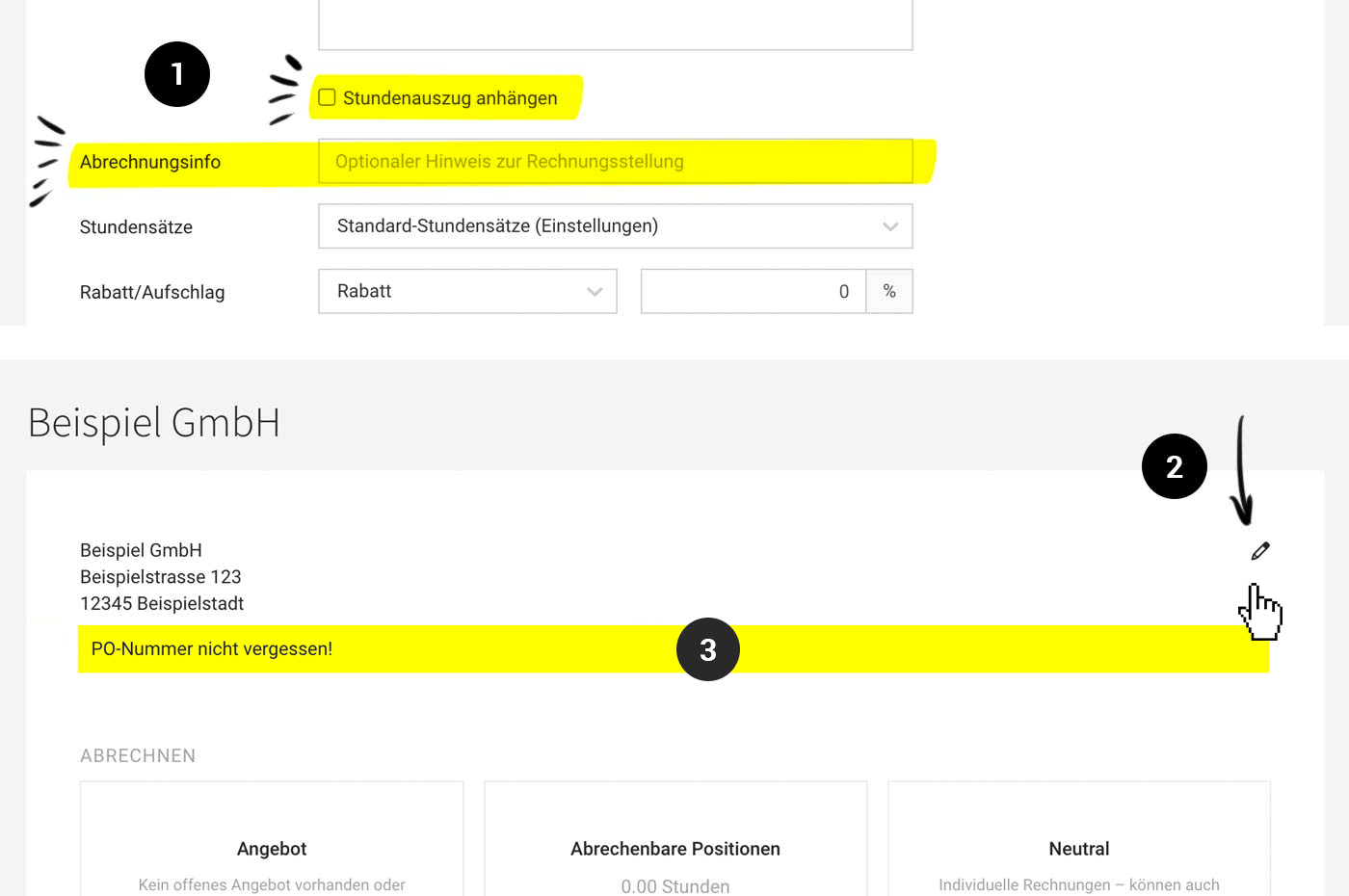

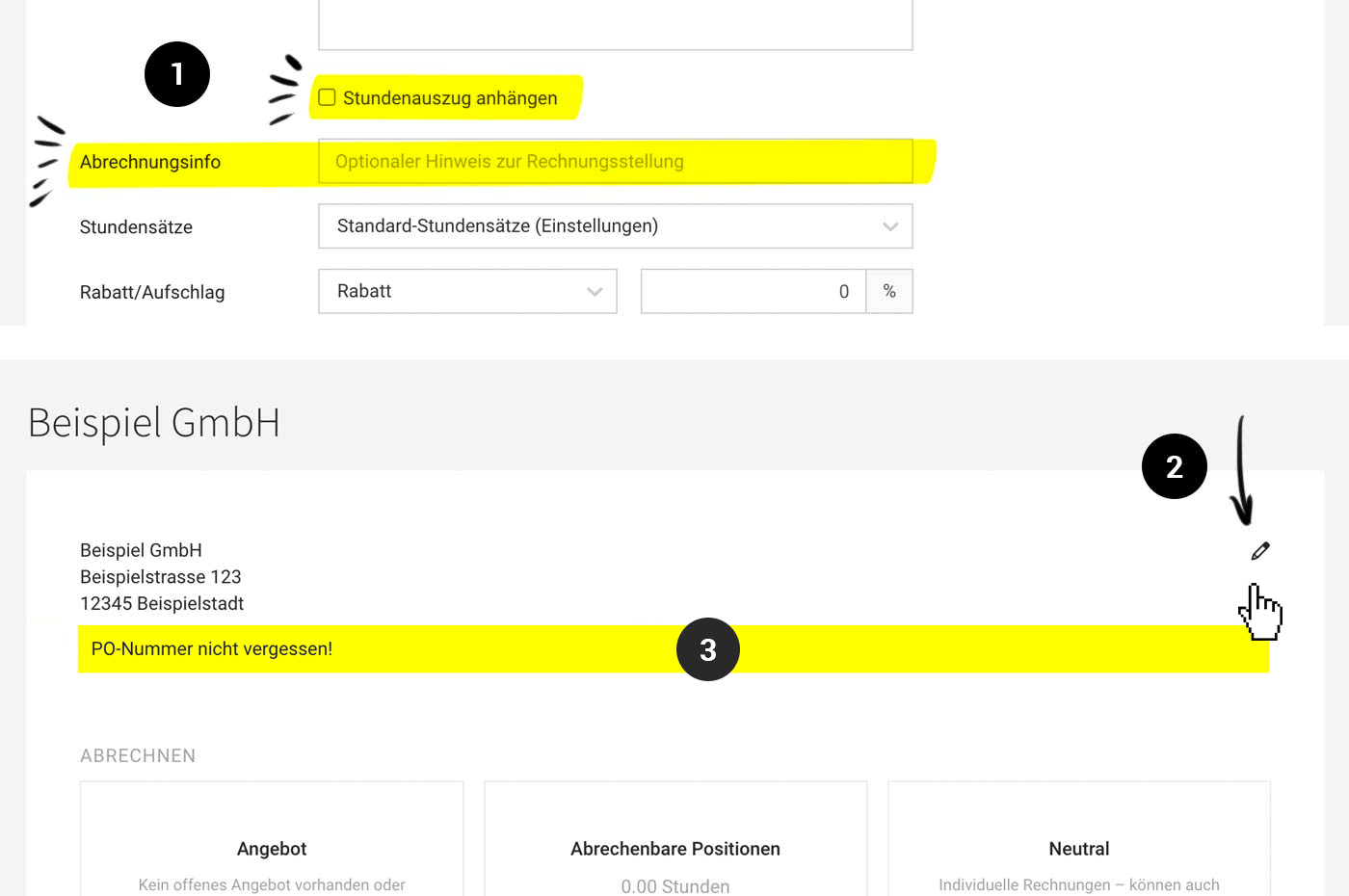

Invoicing Information: Note accompanies the invoice creation

Enter a note in the "Invoicing Information" field (1 + 2). This note accompanies the process from the invoicing page (3) to the final invoice.

This note can be filled in on the invoicing page within the client or project section (menu item "Invoicing" in the client) (2).

(English image not yet available)

(English image not yet available)

Automatically integrate timesheet

If the automatically generated timesheet should be included in the invoice PDF during invoicing, this can already be predefined for the client (1). Alternatively, it can be set at the project level or only with the invoice.

Closing text, discount, rebate, incidental cost allowance

Other agreements such as discounts, incidental cost allowances, or rebates can be recorded directly in the client form under "Additional Options".

Enter a note in the "Invoicing Information" field (1 + 2). This note accompanies the process from the invoicing page (3) to the final invoice.

This note can be filled in on the invoicing page within the client or project section (menu item "Invoicing" in the client) (2).

(English image not yet available)

(English image not yet available)Automatically integrate timesheet

If the automatically generated timesheet should be included in the invoice PDF during invoicing, this can already be predefined for the client (1). Alternatively, it can be set at the project level or only with the invoice.

Closing text, discount, rebate, incidental cost allowance

Other agreements such as discounts, incidental cost allowances, or rebates can be recorded directly in the client form under "Additional Options".

Invoice Numbers

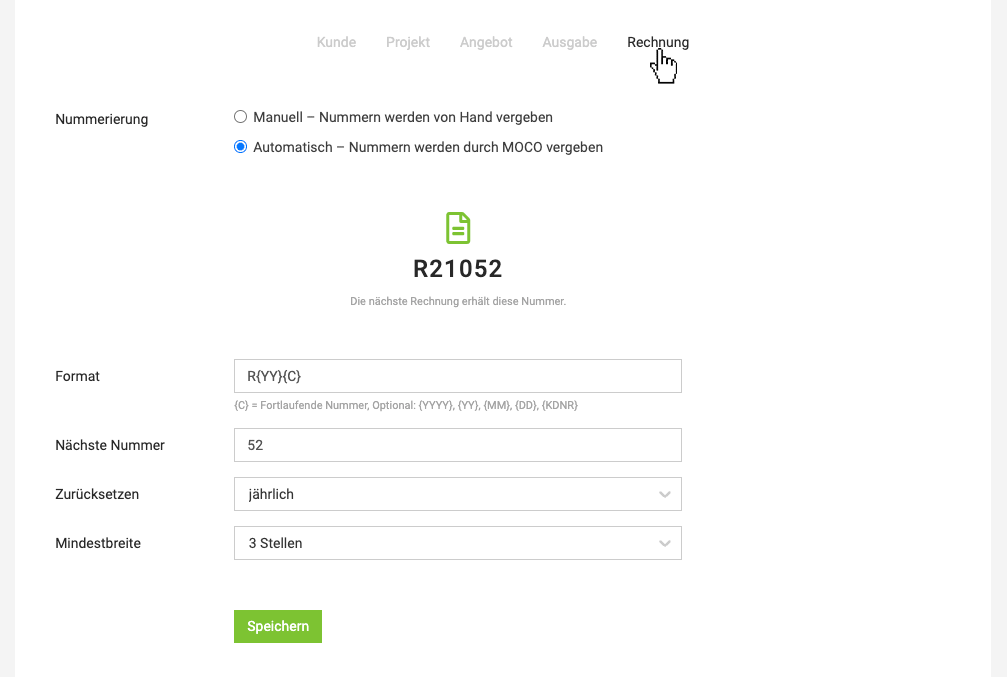

Invoice numbers can be entered manually or automated. The corresponding setting can be found in the settings under "Account" > "Numbering Sequences". Generally, automatic numbering is recommended as it is reliable and ensures seamless numbering automatically. Information & tips on choosing invoice numbering

A seamless numbering is not legally mandatory. However, it is advisable to have gaps documented in a traceable manner. This is easily possible in MOCO. Detailed information on this

A seamless numbering is not legally mandatory. However, it is advisable to have gaps documented in a traceable manner. This is easily possible in MOCO. Detailed information on this

(English image not yet available)

(English image not yet available)Tax Rate & "Reverse Charge"

One Tax Rate per Invoice

Each invoice in MOCO is designed to have one tax rate (correct abbreviation in Germany is USt. and in Switzerland MWST), as service providers invoice using the main-additional service principle with only one tax rate.

Including Travel Expenses etc. with a Different Tax Rate on the Invoice

These are generally considered additional services to the main service. They are included net on the invoice, and the main service's tax rate applies to all items.

Invoices Abroad & Small Business Owners

When invoicing a client based abroad and the tax liability shifts to the service recipient, this is referred to as a reverse charge procedure within the EU. A prerequisite for applying the reverse charge procedure is that the client also holds a tax number/VAT identification number (UID).

The text note for tax exemption, which is then automatically displayed on the invoice, is entered once for the relevant tax rate under Settings > Accounting > Tax Rates

In this case, under "Additional Options" for the client (see illustration), you enter:

Each invoice in MOCO is designed to have one tax rate (correct abbreviation in Germany is USt. and in Switzerland MWST), as service providers invoice using the main-additional service principle with only one tax rate.

Including Travel Expenses etc. with a Different Tax Rate on the Invoice

These are generally considered additional services to the main service. They are included net on the invoice, and the main service's tax rate applies to all items.

Invoices Abroad & Small Business Owners

When invoicing a client based abroad and the tax liability shifts to the service recipient, this is referred to as a reverse charge procedure within the EU. A prerequisite for applying the reverse charge procedure is that the client also holds a tax number/VAT identification number (UID).

The text note for tax exemption, which is then automatically displayed on the invoice, is entered once for the relevant tax rate under Settings > Accounting > Tax Rates

In this case, under "Additional Options" for the client (see illustration), you enter:

- UID – If entered, it will be displayed in the info block on the invoice.

- Tax Rate "0% (EU)" or 0% "(Abroad)"

(English image not yet available)

(English image not yet available)Delivery Notes

When a service provider ships goods, they typically want to create a delivery note as an accompanying document. The delivery note allows the client to verify and identify the type and quantity of goods ordered upon receipt.

The invoice is usually sent separately from the delivery note.

Create a Delivery Note

In the invoice section, select "Delivery Note" at the top right → Confirm/adjust accompanying text and select items → The delivery note is generated and can be printed directly and included with the shipment.

» Standard information on the delivery note and other details

The invoice is usually sent separately from the delivery note.

Create a Delivery Note

In the invoice section, select "Delivery Note" at the top right → Confirm/adjust accompanying text and select items → The delivery note is generated and can be printed directly and included with the shipment.

» Standard information on the delivery note and other details