Article from

Essential Information on QR Invoicing: Switzerland & Abroad

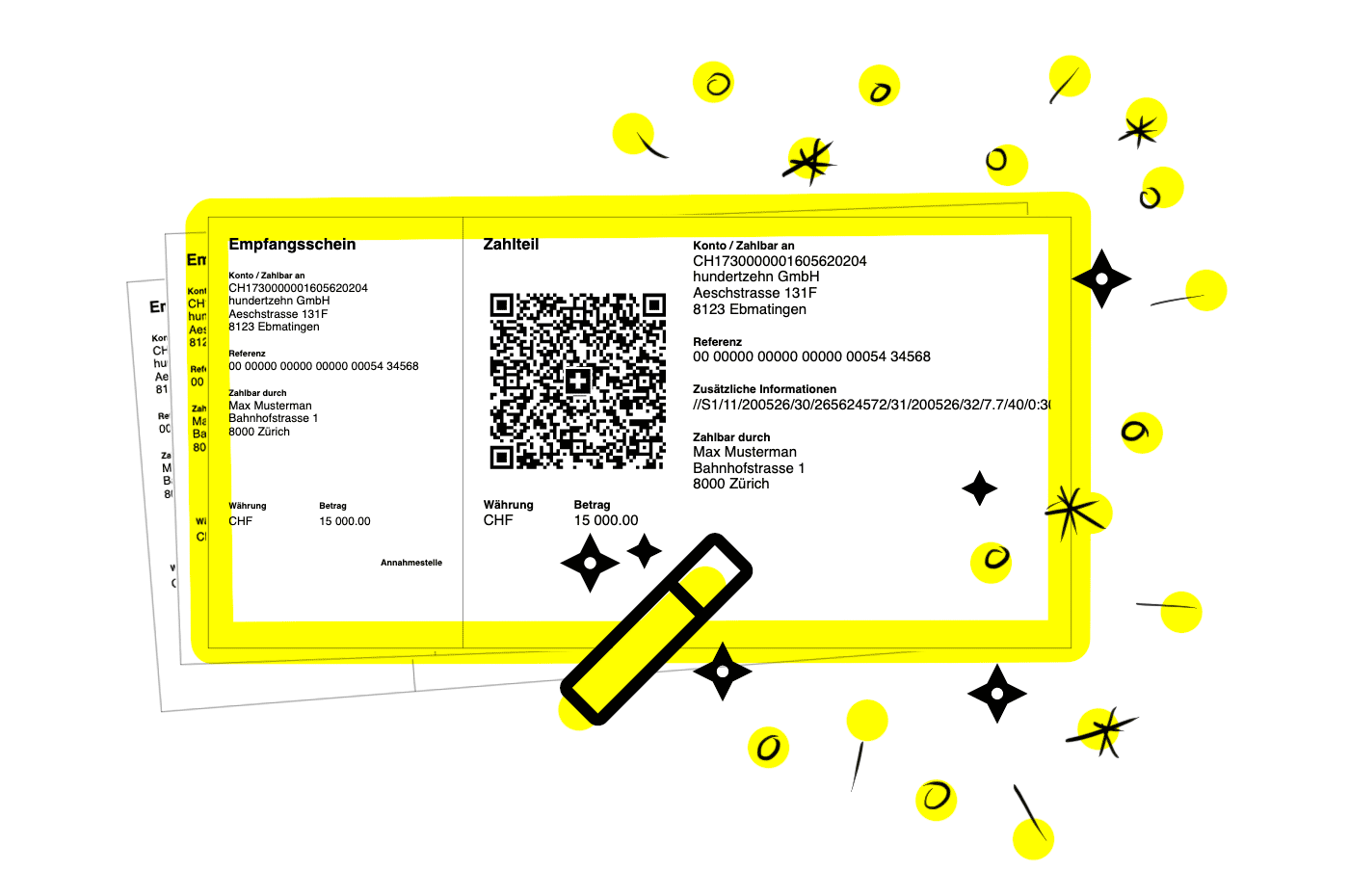

If you issue invoices across borders, you may wonder how QR invoicing works, as it is a standard only in Switzerland. Here are the answers if you use MOCO for invoicing.

(English image not yet available)

(English image not yet available)Liechtenstein < > Switzerland

Liechtenstein is connected to the Swiss payment system.

MOCO generates a QR payment slip

MOCO generates a QR payment slip

Abroad > Switzerland

If you are abroad and your client is in Switzerland or Liechtenstein, your client can only use the QR invoice functions (scanning or reading the QR code) if you, as the invoicer, provide an IBAN or a Creditor Reference from an account in Switzerland or Liechtenstein. However, the invoice recipient can always manually process an international payment via their online or mobile banking.

Therefore, MOCO does not generate a QR invoice

As an EU client, you can use the EPC QR Code (GiroCode)

As an EU client, you can use the EPC QR Code (GiroCode)

Switzerland > Abroad

If you are in Switzerland or Liechtenstein and your client is abroad, it cannot be guaranteed that your client's foreign bank supports the Swiss QR invoice. The Swiss financial sector has no influence over this. In this case, the foreign invoice recipient can use the details on the QR invoice for a manually recorded payment.

Therefore, MOCO does not generate a QR invoice

Therefore, MOCO does not generate a QR invoice