Article from

Synchronise Credit Card Payments and Receipts with MOCO.

MOCO + Pliant: Direct integration of the credit card solution for comprehensive synchronisation of all credit card payments and receipts. Company purchases and employee expenditures are automatically recorded, analysed, and prepared for accounting in MOCO.

.png) (English image not yet available)

(English image not yet available)Benefits of Credit Card Integration

The integrated credit card solution simplifies and enhances the efficiency of managing business expenditures. Key highlights include:

- Automatic recording of all credit card payments.

- Automatic recording of all credit card receipts.

- Supplementary synchronisation from MOCO to Pliant.

- Real-time view in the cash flow report.

- The cardholder is identified in MOCO for each expenditure, ensuring correct allocation.

- The integration is developed and maintained by MOCO and is included in the subscription.

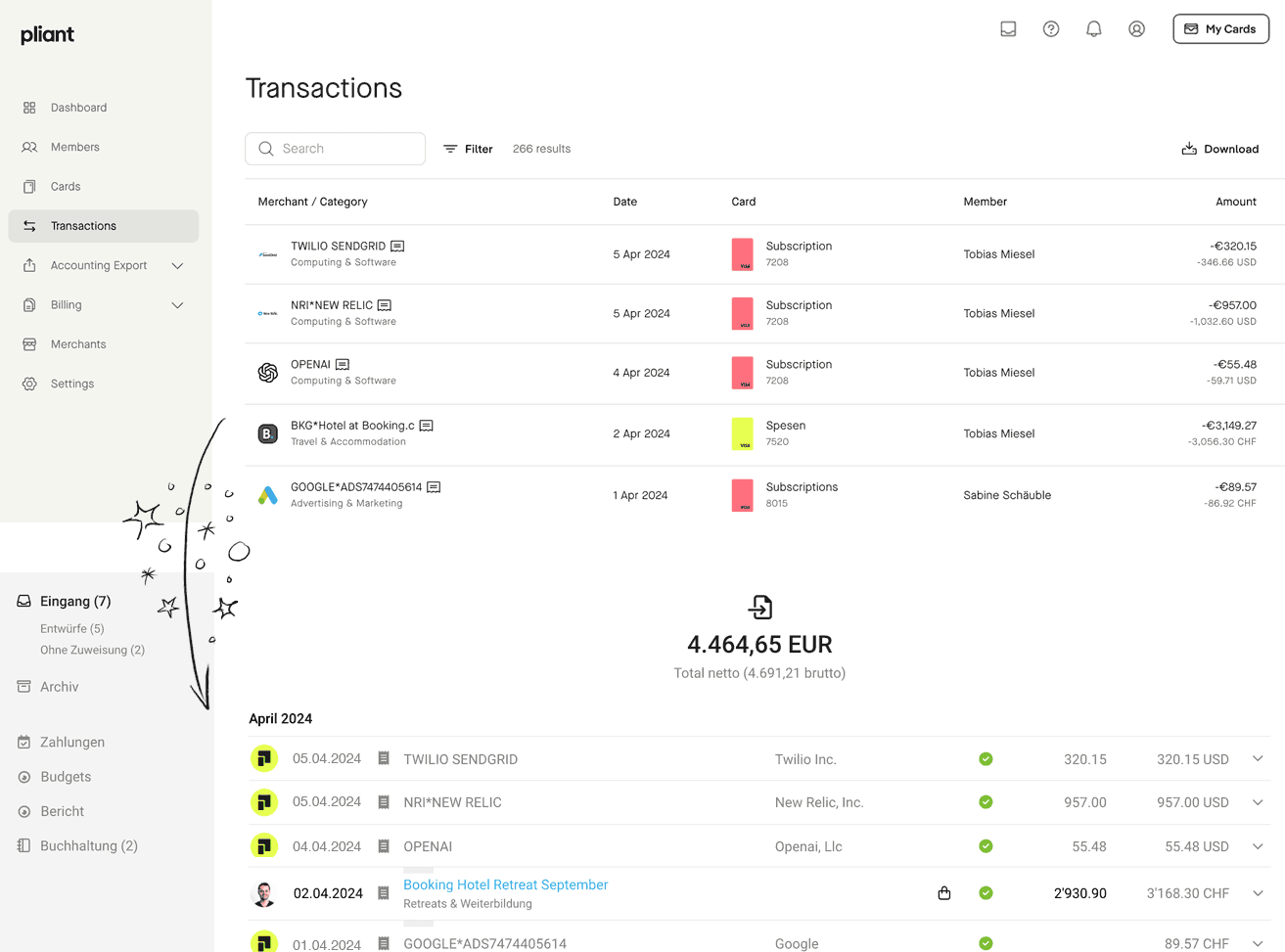

Automatic Recording of All Credit Card Payments

Transactions from Pliant are synchronised as expenditure payments in MOCO. There's no need to reconcile the credit card statement. Transactions not yet booked in Pliant (shown as pending) are displayed in number and total, with a link under "Drafts".

Automatic Recording of All Credit Card Receipts in MOCO

MOCO directly creates expenditure drafts with receipts from Pliant. If text recognition (OCR) is enabled, the receipts are also read.

If the receipt is recorded later in Pliant, it is synchronised retroactively. If the receipt is missing, MOCO still creates an expenditure draft with a note that the receipt is missing.

We recommend always capturing receipts via Pliant. Pliant offers an email address for receipt submission. The receipts are then automatically assigned to the payment.

If the receipt is recorded later in Pliant, it is synchronised retroactively. If the receipt is missing, MOCO still creates an expenditure draft with a note that the receipt is missing.

We recommend always capturing receipts via Pliant. Pliant offers an email address for receipt submission. The receipts are then automatically assigned to the payment.

Supplementary Synchronisation from MOCO to Pliant

If a missing receipt is added to an expenditure draft in MOCO or a payment from Pliant is assigned to an already recorded receipt in MOCO, the receipt is also synchronised to Pliant.

This significantly reduces administrative effort, simplifies receipt tracking, and ensures both systems are always up to date.

This significantly reduces administrative effort, simplifies receipt tracking, and ensures both systems are always up to date.

Real-Time View in the Cash Flow Report

Since payments are recorded immediately after approval from Pliant, they promptly flow into the cash flow report, and you can also see the payment in the Dashboard tile "Outgoing Payments".

Why Use Such a Credit Card Solution?

Here's why it's worthwhile to use such a card solution – aside from the seamless integration into MOCO:

- Completely digital card and receipt management.

- Any number of credit cards can be created for personal expenses, projects, or specific purposes. New employees can instantly receive a card with a click.

- Each card can have an individual limit.

- Cards can be created immediately and added to the smartphone wallet right away.

- You always have an overview of which receipts for credit card payments are still missing.

Popular with Agencies

Many agencies work remotely or in a hybrid model. The digital credit card solution provides a simple, flexible, and yet transparent payment option for management for all employees.

Agencies offering SEA can create a card per ad channel, client, or project and control expenditures with budgets.

Agencies offering SEA can create a card per ad channel, client, or project and control expenditures with budgets.

Pliant

Best-in-Class Approach

Like MOCO, Pliant also follows the best-in-class approach: A few tools focused on specific areas, optimally integrated, provide the best flow and most value.

Unique Comprehensive Integration

The usual approach so far has been "light integrations" – only payments are fetched via finAPI, not receipts. MOCO is currently the first agency software in the DACH region to offer such a direct and comprehensive integration with Pliant credit cards.

Not using Pliant yet but interested? More info on Pliant

Like MOCO, Pliant also follows the best-in-class approach: A few tools focused on specific areas, optimally integrated, provide the best flow and most value.

Unique Comprehensive Integration

The usual approach so far has been "light integrations" – only payments are fetched via finAPI, not receipts. MOCO is currently the first agency software in the DACH region to offer such a direct and comprehensive integration with Pliant credit cards.

Not using Pliant yet but interested? More info on Pliant

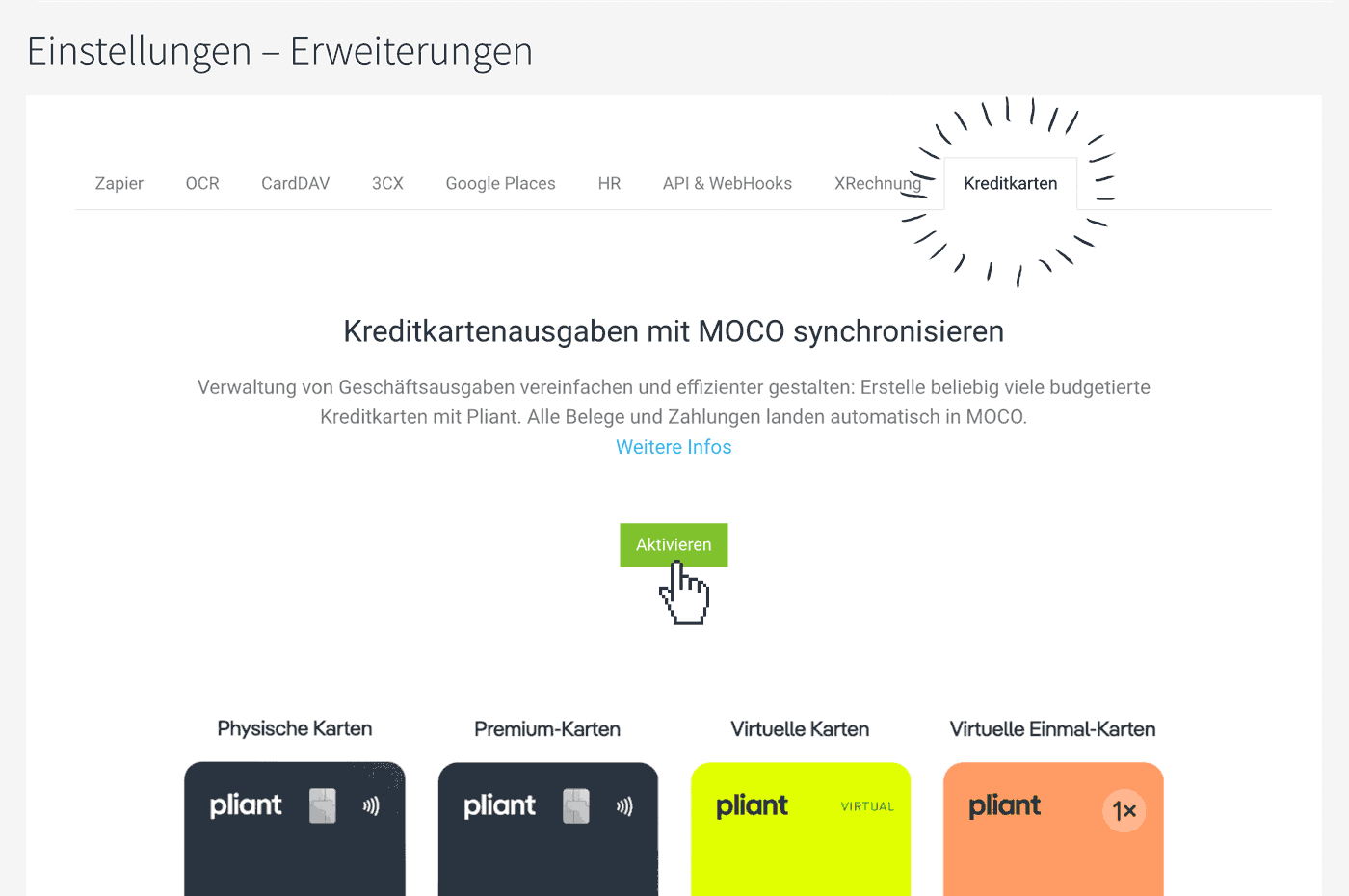

Activate Credit Card Sync

Activation

You activate the option in Settings > Extensions > Credit Cards. After clicking the "Activate" button, you confirm the connection to your pre-created Pliant account.

(English image not yet available)

(English image not yet available)

(English image not yet available)

(English image not yet available)Then You're All Set

The rest happens automatically: As soon as the payments are booked by Pliant, the expenditure draft and payment are automatically recorded in MOCO. The receipts are synced. We describe the mechanics in more detail above.

(English image not yet available)

(English image not yet available)Note for Accounting: Accounting is disabled in Pliant as the preparatory accounting is done via MOCO. Accounting in MOCO

Collected Experience from Practice

We at MOCO use MOCO as our ERP and the Pliant credit card solution for our company for about 3 months. The practical experience played a crucial role in achieving a truly meaningful integration.

This is how the cards work for us: Some employees have a personal virtual card for expenses like travel costs. We also have a credit card through which our subscriptions (tools and other services) run.

This is how the cards work for us: Some employees have a personal virtual card for expenses like travel costs. We also have a credit card through which our subscriptions (tools and other services) run.