Article from

How Much Does an Employee Cost Me? Calculating the Internal Hourly Rate.

How profitable are my projects? What do I really gain from the proposed hourly rate?

Having a rough sense of these figures is crucial to avoid 'working in the dark.' In this context, it's about estimating the approximate cost of an employee per hour. Sure, you could create spreadsheets and calculate everything meticulously. But who really wants to do that – and is it even worth the effort? We say 'No' and aim to show you a pragmatic and practical way to reach your goal.

(English image not yet available)

(English image not yet available)The Benefit of the Internal Hourly Rate

The internal hourly rate allows you to make solid statements in everyday work – primarily about a project's profitability. The costs associated with a project are not just from external services or additional expenses – while employees work on the project, costs for the employee accrue.

Therefore, it's important not to forget to compare the total costs with the revenues.

Calculating the Cost of an Employee per Hour

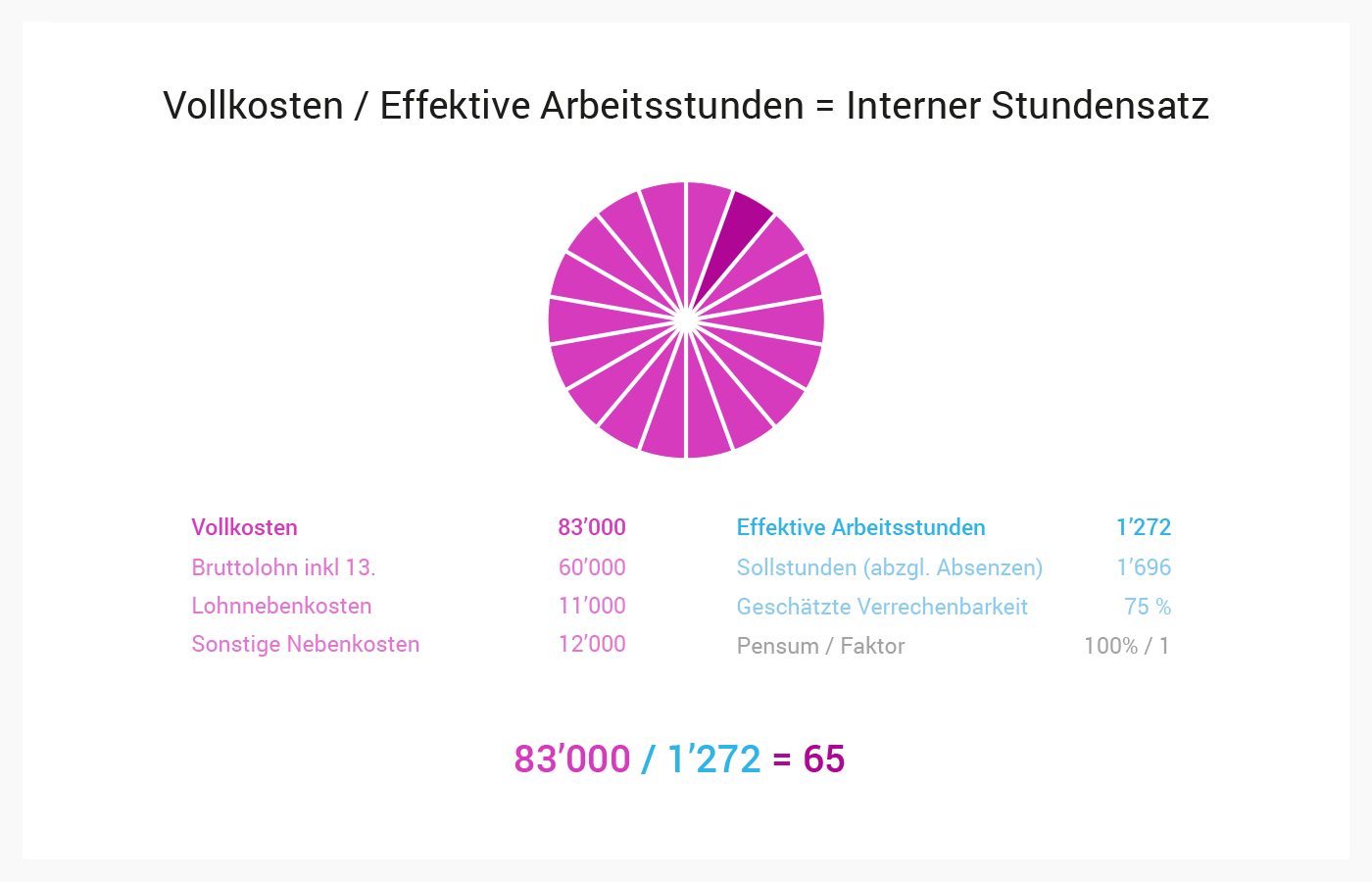

First off: The internal hourly rate will never be an exact figure. We are looking for a number that doesn't need constant adjustment, is easy to grasp, and can withstand slight fluctuations. The simplest formula is:

Total Costs

Include all salary costs and other additional costs that increase per employee. Generally, you could also allocate office rent, but this is usually a consistent recurring amount that unnecessarily complicates the calculation. The total cost calculation consists of:

→ Annual salary (including 13th month, assumed bonus, etc.)

→ Additional salary costs

→ Other additional costs that increase per employee (administration, workplace costs, operational costs, office supplies, coffee & drinks)

Effective Working Hours

The effective hourly rate concerns how many billable hours the employee actually works.

It makes sense to use a general average value for the calculation. Each year not only has a different number of public holidays. Other criteria also contribute to a different number of working days per year. Generally, you can rely on the following benchmarks:

Total Costs

Include all salary costs and other additional costs that increase per employee. Generally, you could also allocate office rent, but this is usually a consistent recurring amount that unnecessarily complicates the calculation. The total cost calculation consists of:

→ Annual salary (including 13th month, assumed bonus, etc.)

→ Additional salary costs

→ Other additional costs that increase per employee (administration, workplace costs, operational costs, office supplies, coffee & drinks)

Effective Working Hours

The effective hourly rate concerns how many billable hours the employee actually works.

It makes sense to use a general average value for the calculation. Each year not only has a different number of public holidays. Other criteria also contribute to a different number of working days per year. Generally, you can rely on the following benchmarks:

Workdays per week | 5

Working weeks per year | 52

Workdays per year | 260

Public holidays on weekdays | 10

Vacation days | 30

Sick days | 5

Other absences | 3

Total workdays | 212

Working hours daily | 8

Total working hours | 1,696

→ Target hours after deducting absences: 1,696

In MOCO: Set up a weekly model, enter public holidays, and subtract the vacation allowance and assumed sick days from the target hours indicated in the 'Target-Actual.' If you've been around for a whole calendar year, you've already calculated this number.

Working weeks per year | 52

Workdays per year | 260

Public holidays on weekdays | 10

Vacation days | 30

Sick days | 5

Other absences | 3

Total workdays | 212

Working hours daily | 8

Total working hours | 1,696

→ Target hours after deducting absences: 1,696

In MOCO: Set up a weekly model, enter public holidays, and subtract the vacation allowance and assumed sick days from the target hours indicated in the 'Target-Actual.' If you've been around for a whole calendar year, you've already calculated this number.

To account for unproductive times, finally deduct, for example, 25% from the calculated working time. Unproductive times include meetings, one-on-one conversations, internal training, or for managers, time spent on leadership tasks. The result for a full-time employee:

→ Effective working hours per year: 1,272

Tips

Tend to Calculate Conservatively

For additional costs and workload, it's better to calculate a bit conservatively and be on the 'safe side' rather than making the figures look too good.

Change with Higher Salary

Rough figures are practical. Contrary to some assumptions, the internal hourly rate often changes only slightly with an increased salary. There are some fluctuations that can never be accurately accounted for. Sometimes, for example, the workload is better or worse.

Average on Level or Team Basis

Ideally, you set an average internal rate for all employees at the same level, even if the salaries vary slightly. This way, you don't have to worry about individuals trying to deduce salaries from internal hourly rates.

You can record the internal hourly rates in MOCO under Settings > Services > Internal Hourly Rates

For additional costs and workload, it's better to calculate a bit conservatively and be on the 'safe side' rather than making the figures look too good.

Change with Higher Salary

Rough figures are practical. Contrary to some assumptions, the internal hourly rate often changes only slightly with an increased salary. There are some fluctuations that can never be accurately accounted for. Sometimes, for example, the workload is better or worse.

Average on Level or Team Basis

Ideally, you set an average internal rate for all employees at the same level, even if the salaries vary slightly. This way, you don't have to worry about individuals trying to deduce salaries from internal hourly rates.

You can record the internal hourly rates in MOCO under Settings > Services > Internal Hourly Rates

Conclusion

The internal hourly rate as a pragmatic benchmark allows you to make solid statements in everyday work. Revenues minus variable costs are also referred to as 'Contribution Margin 1.' The question 'How much does this project bring us?' should be answered with this. From this amount, the company's fixed costs must then be paid. The figure doesn't differ as much with different salaries as often assumed, because there are fluctuations beyond the calculable factors.