Alter News-Artikel!

» Hier geht's zur aktuellen Online-Hilfe

Article from

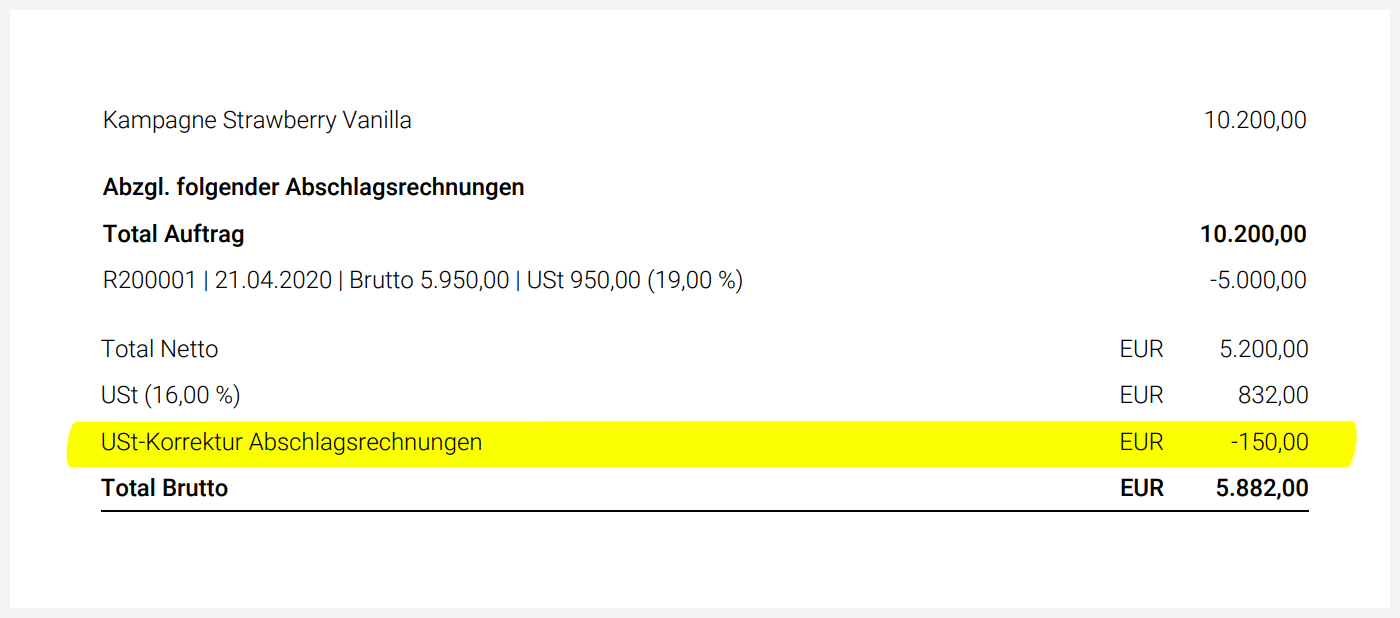

Automatic VAT Adjustment on the Final Invoice.

The temporary VAT reduction as part of the German government's stimulus package poses challenges, especially for interim and final invoices with varying tax rates: Incorrect tax rates need to be corrected.

MOCO now offers an optimisation for this. It simplifies the previously cumbersome process of cancelling and reissuing the interim invoice:

If the tax rates of the interim invoices differ from those of the final invoice, MOCO automatically adjusts the corresponding amount directly on the invoice – and it's only visible on the PDF!

(English image not yet available)

(English image not yet available)

This functionality supports the period from July during the tax reduction – and also afterwards from 1 January 2021, when the reverse situation occurs with interim invoices at 16% and final invoices at 19%.

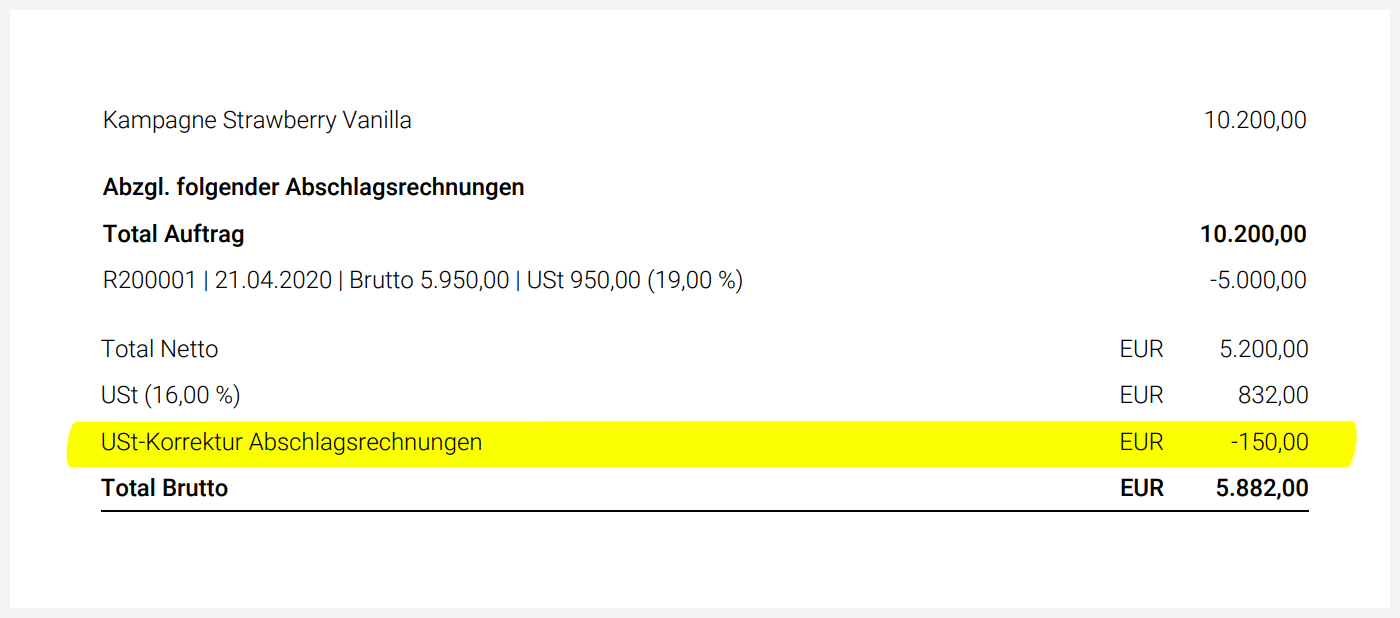

MOCO now offers an optimisation for this. It simplifies the previously cumbersome process of cancelling and reissuing the interim invoice:

If the tax rates of the interim invoices differ from those of the final invoice, MOCO automatically adjusts the corresponding amount directly on the invoice – and it's only visible on the PDF!

(English image not yet available)

(English image not yet available)This functionality supports the period from July during the tax reduction – and also afterwards from 1 January 2021, when the reverse situation occurs with interim invoices at 16% and final invoices at 19%.