-------

MOCO + XRechnung to Authorities (DE)

Invoice contents structured and machine-readable as XML file

The creation of e-invoices will be available in MOCO without integration/third-party providers by the end of March, in line with the B2B e-invoicing obligation in Germany (becomes mandatory after the transition periods until the end of 2026)

Free online tool for creating e-invoices in special cases temporarily: https://tools.pdf24.org/de/elektronische-rechnung-erstellen

Free online tool for creating e-invoices in special cases temporarily: https://tools.pdf24.org/de/elektronische-rechnung-erstellen

XRechnungen to Federal Clients

Since the end of 2020, invoices in Germany to federal clients over 1000 EUR must be submitted digitally in the XRechnung format.

Option 1: Invoicing via Federal Platform

For creating and sending an e-invoice to the federal government, the XRechnung format has been mandatory since 2020. The XRechnung can be generated and transmitted either through the official federal internet platform or independently via software.

The federal e-invoicing platform allows you to create e-invoices via a web form, submit already created e-invoices, or check the processing status of your submitted e-invoices.

The federal e-invoicing platform allows you to create e-invoices via a web form, submit already created e-invoices, or check the processing status of your submitted e-invoices.

- Central Invoice Submission Platform of the Federal Government (ZRE)

- Further information from the federal government on the Peppol transmission channel

Option 2: Create Invoices for Federal Clients Directly from MOCO via Faktoora

With the integration of Faktoora, you can create XRechnungen for public clients directly from MOCO. This option is ideal if you need to create many of these invoices regularly.

Set Up Faktoora Integration

First, you need to create an account with Faktoora (paid) and request the activation of the function via MOCO's in-app support. Once activated, the function is available in MOCO:

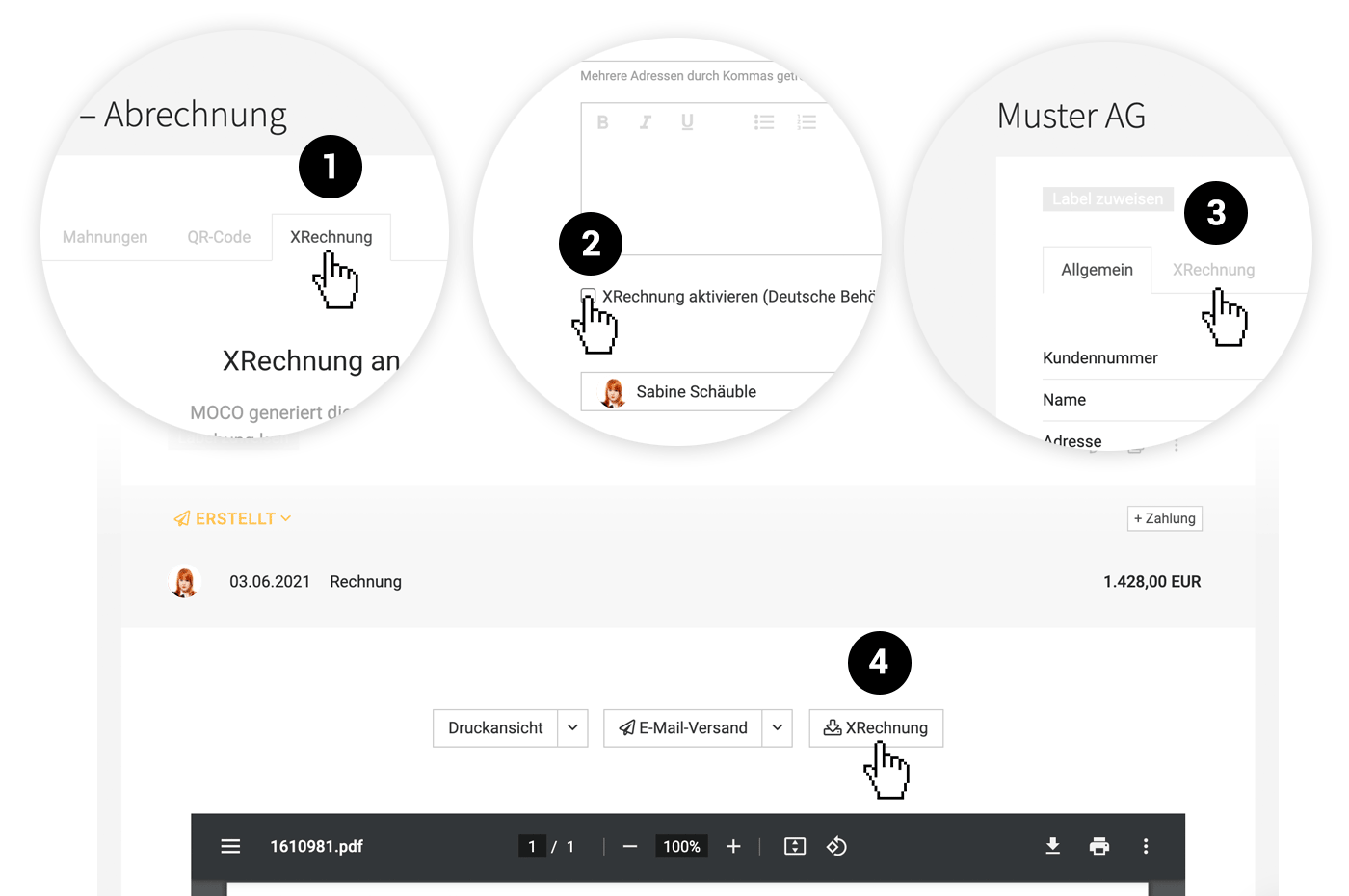

1. Activate the option in MOCO (Settings > Extensions > XRechnung > Enter details) (1)

2. Activate for the relevant client (checkbox in the form under "Additional Options") (2)

3. Enter relevant details in the "XRechnung" client tab that appears. (3)

1. Activate the option in MOCO (Settings > Extensions > XRechnung > Enter details) (1)

2. Activate for the relevant client (checkbox in the form under "Additional Options") (2)

3. Enter relevant details in the "XRechnung" client tab that appears. (3)

English image not yet available...

English image not yet available...How to Create an Individual XRechnung

4. A new "XRechnung" button will appear at the top right of each invoice (4). Use this to download the XRechnung and send it via your email program.

Capture any project-related order numbers or a contact person (not mandatory for all recipients) during the download query. It's best to enter the information required by the recipient in advance on the invoicing page under "Invoicing Info" so that it's readily available later.